Call to cut $650 million in ‘Grinch-like’ card fees

Australians are expected to spend more than $96 billion on their credit and debit cards this festive season[1], but will be forced to pay in only two months $650 million in ‘Grinch-like’ bank fees for the pleasure.

These are hidden interchange fees that banks charge each other for the use of credit and debit cards that are levied on retailers who often pass them onto consumers in the form of a surcharge or higher-priced goods.

The Christmas and New Year’s sales season is critical for retailers, with many relying on the next eight weeks for up to 60 per cent of their annual turnover.

The issue is likely to come to a head today when the Reserve Bank of Australia’s (RBA) Payments System Board (PSB) meets to decide the direction of its interchange fee regulation.

Australian retailers and their customers have paid an estimated $1.6 billion[2] in these unnecessary and antiquated fees this year and small businesses and low-income Australians have been hit the hardest.

The PSB has the power to save 10 million lower-income Australians $550 million a year in unnecessary credit and debit card fees[3], if it caps the credit card interchange fee at 0.3 per cent as the European Commission has.

The fee restrictions could also save the country’s 390,000 small businesses an estimated $300 million a year in fees[4].

In a submission to the PSB, Tyro Payments CEO Jost Stollmann implored the RBA to “again lead the regulatory world by eliminating interchange fees that the banks charge each other and force onto merchants and consumers”.

“At a time when Australian banks are enjoying record-breaking profits, greatly assisted by the growth in electronic fees, it is unjustifiable that cost efficiencies haven’t been passed onto small businesses and their customers,” he said.

“In an increasingly cashless society, it is the big banks who are the real winners.

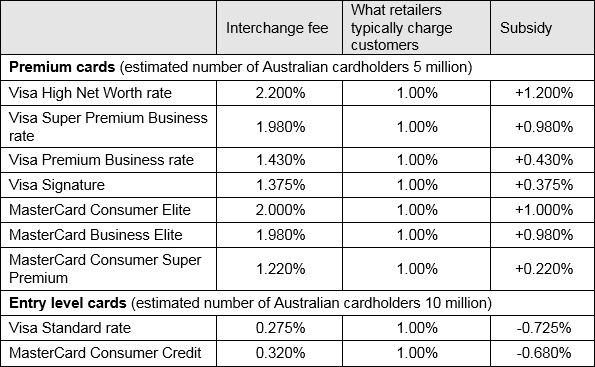

“Low-income Australians and small-to-medium business owners have been the losers as interchange fees for small businesses are up to 10 times higher than for big retailers[5] while low-income consumers pay 6.7 times more than high net worth individuals with premium credit card schemes.”

Tyro argues that by abolishing the interchange fee a beneficial chain of events would end regulatory complexity, abolish unfair cross-subsidies and eliminate vexing surcharging.

“Consumers would enjoy relief from rising cost of living pressures, while retailers struggling in an increasingly competitive market would become more profitable and competitive,” he said.

“Today, we call on the PSB to draw a line in the sand and eliminate interchange fees by regulating for the future.”

A hard cap of 0.3%, as foreshadowed in the RBA’s 2007-08 Review and as legislated in the European Union, would liberate Australians of estimated bank fees of $550 million and possibly hundreds of millions more each year.

New Zealand, Canada and eight EU member states have all moved to low or zero debit interchange fees.

Ninety-three percent of respondents to a recent survey of Tyro merchants want interchange fees to be either capped or abolished altogether. And best of all,

98 percent said they would scrap surcharging as a result

Table 1: Premium and entry level card charges and ‘subsidies’

[1] Estimated card transaction volume in November and December 2015 (RBA).

[2] RBA statistics.

[3] $450 million in fees on $225 billion in credit card transactions through a 0.2% lower cap, estimated $100 million through elimination of the creep between reviews and potential hundreds of additional millions through the inclusion of companion charge cards.

[4] Comparing the lower and higher quartiles of the yearly $230 billion in Visa and MasterCard purchases.

[5] Visa: Strategic Merchant Program rate 0.22% versus High Net Worth Qualified rate 2.20% and Standard rate 0.275%.

Need to know more?

For more about this news story please contact:

Monica Appleby, Head of Corporate Communications on 0466 598 946 or mappleby@tyro.com

Sophie Cotterill, Corporate Communications Manager on 0414 960 292 or scotterill@tyro.com

Get the help you need

Get the help you need