Aussies to save $200 million a year on card payment fees.

As Australians embark on their $18 billion Christmas spending blitz, changes proposed by the RBA to unnecessary card payment transaction fees mean that they would collectively save an estimated $200 million a year at the cash register.

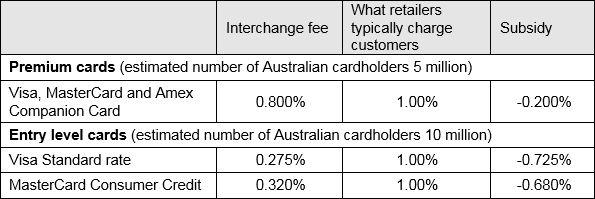

According to analysis from SME champion Tyro Payments, changes to interchange fees mean that 10 million of the lowest income Australians could save $50 a year.

The proposed new regulation falls short of the estimated $750 million it could have saved consumers and retailers, if the RBA had followed the European Union lead with a hard cap of 0.3% on interchange fees.

Tyro Payments, CEO, Jost Stollmann said that while “the changes proposed by the RBA are encouraging more needs to be done.”

“This is a step in the right direction, however, the proposed changes to the card interchange fee are essentially invisible to the average customer and small business. The only real option is to ban interchange fees altogether.”

Lower income Australians will still be subsidising the spending habits of Australia’s wealthiest to the tune of hundreds of million dollars a year, money that could otherwise be spent on gifts under the Christmas tree for friends and family.

“Why should lower income Australians and small businesses continue to fund the although now somewhat less generous reward programs of platinum and super premium cards for the wealthy? The RBA needs to go the whole way and abolish the fees completely.”

“Australia is well behind the eight ball, with New Zealand, Canada and eight other EU members having very low or zero debit interchange fees.” Mr Stollmann said.

The Reserve Bank revealed the direction it wants to take in a consultation paper on draft changes to the standards on interchange fees released last week. This included:

- A hard cap of 0.8 percent on interchange fees and the inclusion of international cards in calculating the average cap of 0.5 percent will save Australian businesses and consumers an estimated $100 million.

- A quarterly instead of a three yearly review of the schemes’ and banks’ compliance with the average cap of 0.5 percent will save another estimated $100 million through elimination of the creep between reviews.

- The inclusion of American Express companion charge cards under the average cap of 0.5 percent and the hard cap of 0.8 percent will add further savings.

“The proposals are encouraging but just don’t go far enough,” argues Mr Stollmann.

In its submission to the RBA, Tyro will argue that the interchange fee must be set at zero, due to the fact that in the era of contactless payments the big banks and credit card scheme companies have removed all transparency and choice with regards to card payments from the Australian consumer and retailer.

“It would finally eliminate what most Australians would be horrified by, if they understood it: that their hard-earned cash is subsidising the rich. It’s Robin Hood in reverse, unfair and unAustralian,” Mr Stollmann said.

“Getting rid of the interchange fee eliminates regulatory complexity, the unfair cross-subsidies, the vexing surcharging (reversing interchange), barriers to innovation and catapults Australia into the cashless society,” said Mr Stollmann.

Table 1: Premium and entry level card charges and ‘subsidies’

Need to know more?

For more about this news story please contact:

Monica Appleby, Head of Corporate Communications on 0466 598 946 or mappleby@tyro.com

Sophie Cotterill, Corporate Communications Manager on 0414 960 292 or scotterill@tyro.com

Get the help you need

Get the help you need