Ending the banks’ double dip could save consumers $500 million in fees

UP to 10 million lower-income Australians will save $500 million a year in unnecessary credit and debit card fees, under caps being considered by the Reserve Bank of Australia (RBA) tomorrow.

The fee restrictions could also save the country’s 390,000 small businesses an estimated $300 million a year [1] in fees.

The big losers will be Australia’s major banks.

The potential savings will be debated at a roundtable of regulators, big banks, and card issuers such as Visa and MasterCard in Sydney tomorrow.

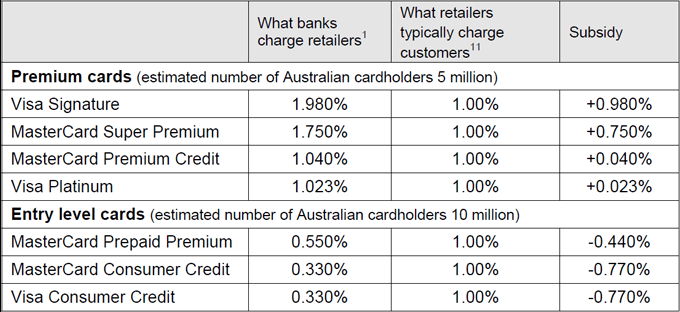

The RBA will consider imposing lower and hard caps on ‘interchange’ fees, that banks charge each other for the use of credit and debit cards, which flow on to consumers and retailers.

Australia’s leading independent payments provider, Tyro Payments, has been campaigning for the fee to be abolished or at least capped.

Tyro Payments CEO Jost Stollmann said the fee is particularly cruel at a time when banks are enjoying the biggest spread between credit card interest rates and the official cash rate since records began in 1990.

“The big banks are double dipping with card payments,” Stollmann said.

“How can they justify taking as much as 20% on some credit cards while the official cash rate sits at 2%? Then they slug consumers and retailers with another fee to use one of their cards, just because they can get away with it.”

Interchange fee on credit cards, currently regulated at an average of 0.5%, has actually blown out beyond 0.6%.

To go to a hard cap of 0.3%, as foreshadowed in the RBA 2007-08 Review and as legislated in the European Union, would liberate Australians of estimated bank fees of $550 million and possibly hundreds of millions more p.a. [2]

New Zealand, Canada and eight EU member states have all moved to low or zero debit interchange fees.

The changes come as 99 percent of Australian small businesses want interchange fees to be either capped or abolished altogether. 96 percent would scrap their surcharge.[3]

“If these welcome changes go ahead, consumers will enjoy relief from rising cost of living pressures, while retailers struggling in a difficult market will become more profitable and competitive,” Stollmann said.

“It is only the banks that stand to lose in fees. It will be interesting to see whether the banks back their customers or their own self-interest in this debate.”

Interchange fees for small businesses are up to 10 times higher than for big competitors [4] while low-income consumers pay 6.7 times more than high net worth individuals. And that divide is widening.

“Australia’s 390,000 SMEs employ more than seven million Australians and are the engine of jobs growth in this country, yet they are having to compete with financial lead in their saddle bags, courtesy of our major banks.”

[1]Comparing the lower and higher quartiles of the yearly $230 billion in Visa and MasterCard purchases.

[2] $450 million in fees on $225 billion in credit card transactions through a 0.2% lower cap, estimated $100 million through elimination of the creep between reviews and potential hundreds of additional millions through the inclusion of companion charge cards.

[3] 729 responses to a Tyro survey as of 19 June 2015 8:45am.

[4] Visa: Strategic Merchant Program rate 0.22% versus High Net Worth Qualified rate 2.20% and Standard rate 0.33%.

Need to know more?

For more about this news story please contact:

Monica Appleby, Head of Corporate Communications on 0466 598 946 or mappleby@tyro.com

Sophie Cotterill, Corporate Communications Manager on 0414 960 292 or scotterill@tyro.com

Get the help you need

Get the help you need