How can we help?

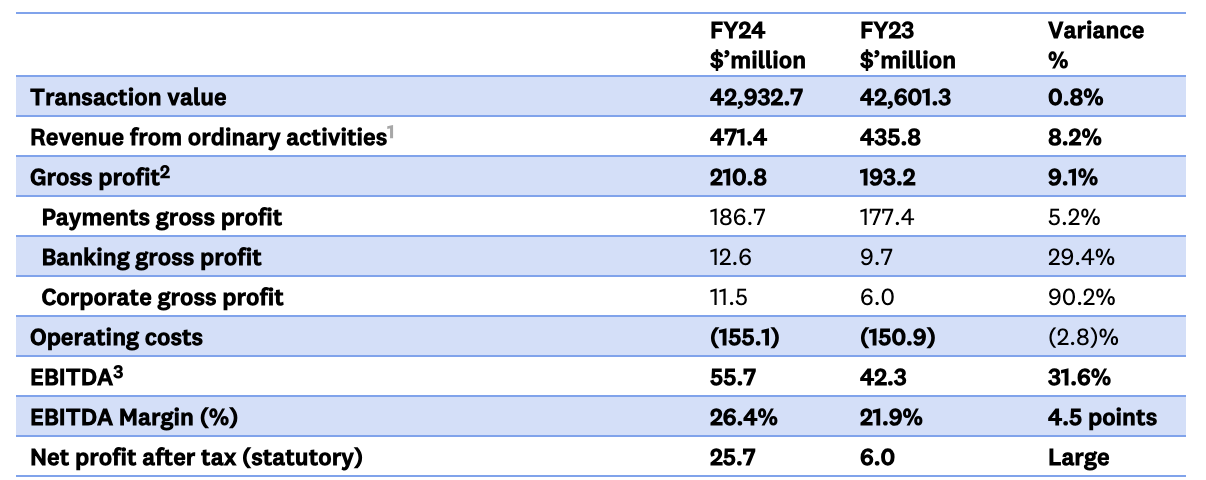

• Gross profit grew 9.1% year-on-year to $210.8 million driven by:

• Successful pricing transformation.

• 21% growth in Health transaction volume.

• Strong uptake of integrated banking, with a 27% increase in banking users and 29.4% increase in banking gross profit.

• EBITDA grew 31.6% year-on-year to $55.7 million, with an EBITDA margin of 26.4%.

• Net profit after tax (statutory) increased four-fold to $25.7m (FY23: $6.0m).

• Free cash flow grew five-fold year-on-year to $30.4 million (FY23: $5.7m).

Sydney, 26 August 2024 – Tyro Payments Limited (Tyro or the Group) today announced its full year results for the 2024 financial year. The Group reported an increase in gross profit and EBITDA, as well as a five-fold increase in free cash flow.

Summary of Results (normalised unless stated otherwise)

* Percentages and totals are based on full reported numbers (i.e., non-rounded source data)

Tyro CEO and Managing Director Jon Davey said: “We are pleased to announce a strong set of results for FY24. Our focus on delivering sustainable, profitable growth led to $55.7 million of EBITDA, up 31.6%, and an EBITDA margin of 26.4%. We also generated $30.4 million of free cash flow, up five-fold from FY23, and strong net profit of $25.7 million.”

Tyro continued to launch enhancements for merchants and partners in FY24, with highlights including:

• Next-generation Android Tyro Pro terminal;

• Embedded payments software development kit (SDK) for developers and POS providers;

• New online payments features in Tyro Merchant Portal;

• Strong partner growth, including new integration with global health insurer;

• New integrations driving partner innovation through proprietary Loyalty and Pay APIs;

• Strong uptake of integrated banking, with a 27% increase in banking users.

Tyro CEO and Managing Director Jon Davey said: “We are here to make payments the easiest part of doing business, whether that be in-store, on-the-go or online. This year we accelerated the delivery of game-changing solutions for our merchants and partners including our Tyro Pro terminal and embedded payments software development kit, which allows partners to embed our payments technology into a wide range of devices.”

“We also continued to innovate to bolster our online payments offering for merchants and our broad partner network, which increased by more than 100 active partners this year. Merchants can now process payments within the Tyro Merchant Portal and send payment invoice links directly to customers. We also enabled card-matching for Australian-first instant cashback app, Hello Clever, and integrated payments for StoreConnect, the first Salesforce-native POS for small businesses.”

“Our integrated banking products remain a valuable part of our customer value proposition, allowing merchants to pay and get paid easily. In FY24, active Tyro banking users grew 27%, reflecting our strong value proposition.”

Tyro will leverage its unique in-house payments infrastructure to enter new verticals in 2025.

Tyro CEO and Managing Director Jon Davey said: “We remain focused on extending our product offering and continuing to develop valuable innovations for our partners and merchants. In FY25, we will enter two new verticals where we have a unique capability that will provide a competitive advantage, including unattended payments and a growing vertical adjacent to Health. With these initiatives in play, we are confident in our runway for growth.”

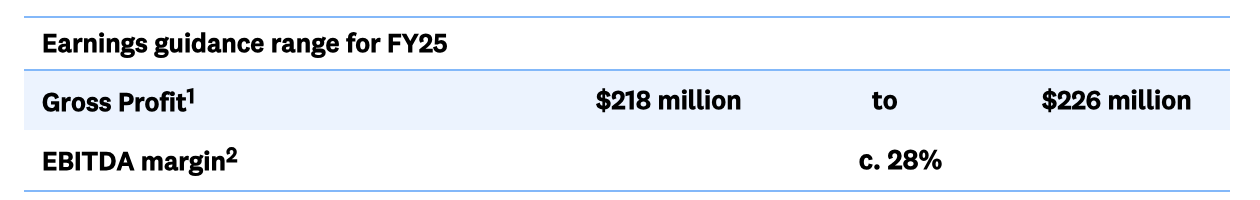

Tyro expects continued gross profit growth and improved profitability, despite ongoing challenging market conditions facing our merchants.

• Gross profit of between $218m and $226m in FY25 at an EBITDA margin of c.28% expected in FY25.

• Tyro also announced medium-term targets that demonstrate a commitment to delivering profitable and sustainable growth, expecting to deliver ‘Rule of 40’ or greater for FY26 onwards (basis: normalised gross profit growth + EBITDA margin).

Tyro also reported a strong capital position and announced the establishment of the Tyro Employee Share Trust (the Trust) to purchase shares on-market to fulfil its future issuance commitments to its employees. The Trust expects to purchase up to $5 million of shares within the FY25 year as part of its capital management initiatives.

For detailed commentary, please refer to Tyro’s FY24 Annual Report and FY24 Investor Presentation.

A briefing for investors, analysts and media will be held at 9:30am Australian Eastern Standard Time (AEST) today. The briefing will be hosted by Tyro CEO and Managing Director Jon Davey and CFO Prav Pala. Participants can register for this webinar here: FY24 Results Investor Presentation Registration. Registered participants will receive the details to the webinar upon registration. For more information, please contact:

Media: Gemma Garkut, +61 422 040 559, media@tyro.com

Investors: Martyn Adlam, +61 452 112 621, investorrelations@tyro.com

Pursuant to Listing Rule 15.5, Tyro confirms this document has been authorised for release by its Board of Directors.

In 2003, Tyro set out to make payments the easiest part of doing business. Today, we’re still into business big time, powering more than 71,000 merchants across Australia with in-store, online and on-the-go payment solutions. Working with more than 700 partners, we create seamless payment experiences for hospitality, retail, services and health providers, with integrated banking and lending solutions designed to help unlock the potential of every business.

Forward-Looking Statements: Tyro’s financial expectations and guidance included in this announcement are subject to there being no material deterioration in market or macroeconomic conditions, and are based on a number of key assumptions which may not prove to be correct, or which may change over time, including no material changes to current business plan and no material change in the regulatory environment. During the ordinary course of business, the Group is exposed to credit risk, operational risk, market risk, macroeconomic risk and liquidity risk. For details on the management of these risks, please refer to the Annual Report including the Operating & Financial Review and the Financial Report for the year ended 30 June 2024. Certain statements contained in this announcement are forward-looking statements or statements about future matters, including indications and expectations of, and guidance and outlook on, the future earnings, financial position and/or performance of Tyro. These statements are based on information available as at the date of this announcement and involve known and unknown risks and uncertainties and other factors (many of which are beyond the control of Tyro). No representation is made or guarantee given that the occurrence of any of the events expressed or implied in these statements will actually occur. Actual future events may vary from these forward-looking statements and it is cautioned that undue reliance should not be placed on any forward-looking statement.

Australian-based 24/7 support