Tyro delivers EBITDA of $42.3M, generates positive free cashflow and net profit

FY23 Highlights

- Gross profit grew 30% year-on-year to $193.2 million.

- Transaction value increased 25% year-on-year to $42.6 billion.

- Record EBITDA of $42.3 million (FY22: $10.7m) and an EBITDA margin of 22%.

- First year of positive free cash flow as a publicly listed company generating $5.7 million.

- First-to-market release of Tyro BYO iOS app for Australian launch of Apple’s Tap to Pay on iPhone payment acceptance technology.

- Merchant numbers in Tyro core business grew 14%, including a 24% uplift in Health providers and 21% uplift in Services merchants, with total merchant growth of 8%.

- Strong take-up of business banking, with $149.7 million in loan originations (up 51% year-on-year) and $92.7 million in deposits (up 11% year-on-year).

FY24 Outlook

- Continued growth expected driven by non-discretionary and new verticals, banking and product innovation, despite moderating spend in discretionary verticals.

- FY24 guidance: Transaction value between $45b – $47.5b, Gross Profit range of $206m – $215m and EBITDA between $52m and $58m.

Sydney, 29 August 2023 – Tyro Payments Limited (Tyro or the Company) today announced its full year results for the 2023 financial year. Driven by a disciplined focus on cost and accelerated product delivery, the Company reported record transaction value, gross profit, and EBITDA, as well as its first full-year positive free cash flow result since listing on the ASX.

The Company will hold a webinar for investors today at 9:30am (AEST) and will provide an update on strategy at an Investor Day on 18October 2023.

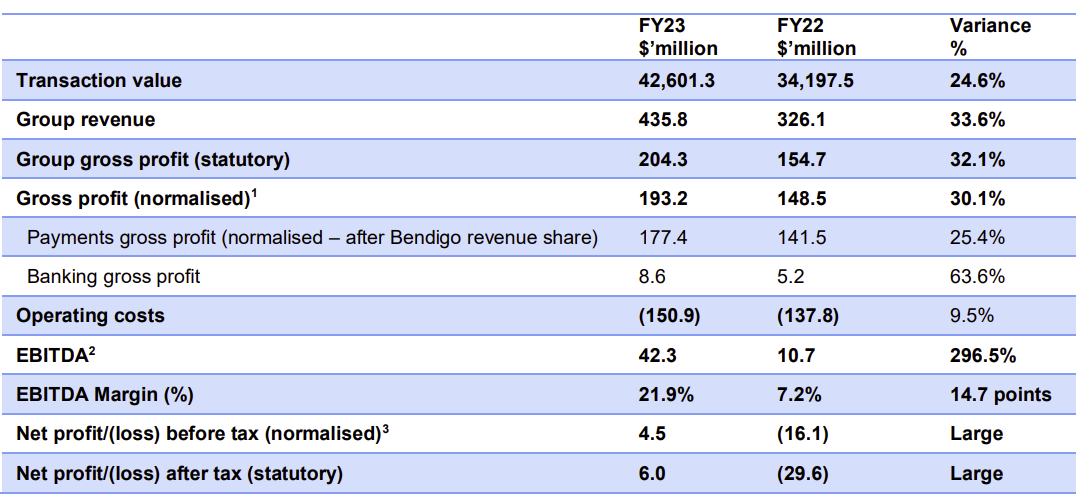

Summary of Results

* Percentages are based on full reported numbers (i.e., non-rounded source data)

- Normalised gross profit is adjusted for Bendigo support fees of $1.0 million associated with transition of Bendigo merchants to the Tyro platform, the Bendigo gross profit share of $8.1 million not deducted from statutory gross profit but deducted to calculate normalised gross profit and a fair value gain of $4.0 million on the recognition of me&u as a financial asset.

- Tyro uses EBITDA as a non-IFRS measure of business performance, which excludes the non-cash impact of share-based payments expense, share of losses from associates, change in accounting treatment of investments and one-off costs to implement the cost reduction program and any M&A related spend.

- Refer to page 25 of the FY23 Investor Presentation for a reconciliation of statutory to normalised results.

Tyro CEO Jon Davey said: “We are pleased to report our results for FY23, with 25% growth in transaction value and 30% growth in gross profit. Our focus on operational efficiency contributed to EBITDA of $42.3 million, up 297% on the prior year. We also achieved $5.7 million of free cash flow.”

Leaner and refreshed management team drives operating efficiency and growth

Tyro introduced a new operating model in April 2023 to create a leaner and more disciplined organisation. This included a smaller and refreshed executive management team with key executive appointments including Dominic White as Chief Product Officer, Deanne Bannatyne as Chief Growth Officer, and Adrian Perillo as CEO of Tyro Health.

Tyro CEO Jon Davey said: “With refreshed leadership and a new operating model, we have prioritised initiatives that deliver measurable results, as well as improved operating leverage and profitability.”

Accelerated delivery and innovation

The delivery of key product and customer experience initiatives was accelerated in the year, with the following solutions launched:

- Tyro Go mobile EFTPOS reader.

- Tyro BYO payment acceptance app for iOS (Tap to Pay on iPhone).

- Tyro Pro next generation terminal.

- Digital onboarding of merchants.

- Optimised pricing, including least cost routing (LCR) and a pilot of No Cost EFTPOS.

- Tyro CEO Jon Davey said: “This year we have demonstrated an ability to innovate and deliver our strategic priorities. The launch of Tyro Pro, Tyro Go, and Tyro BYO has strengthened our product offering for businesses who seek flexible, cost-effective payment acceptance solutions.”

Broadened distribution channels and improved industry diversification

We increased our ability to reach more Australian merchants by securing key distribution partnerships and improved diversification of merchant applications in specialised industries.

Tyro CEO Jon Davey said: “We have been pleased with the growth in key industry verticals, particularly a 24% uplift in the number of Health merchants and a 21% uplift from the emerging Services sector. The year also marked the beginning of our flagship partnership with Telstra and Australia Post, bolstering our distribution to small businesses through 800 retail stores across the country.”

Trading Update and FY24 Guidance: Continued profit growth

- $6.5 billion transaction value processed for the period 1 July to 25 August, up 6.3% on the corresponding period. July EBITDA $4.1m (up from $2.2m) and EBITDA margin 24% (up from 14%).

- Tyro is targeting EBITDA of $52m to $58m, from a transaction value range of $45.0 billion to $47.5 billion. This takes into consideration both an expected reduction in discretionary spending and strong growth in non-discretionary verticals. Tyro is targeting a continued improvement in positive free cash flow5 (after all operating expenses and capital expenditure).

For detailed commentary, please refer to Tyro’s 2023 Annual Report and FY23 Investor Presentation.

Investor webinar

A briefing for investors and analysts will be held at 9:30am Australian Eastern Standard Time (AEST) today. The briefing will be hosted by Tyro CEO Jon Davey and CFO Prav Pala.

Investors, analysts and media can access this briefing using the following registration details: Tyro Payments FY23 Investor/Analyst Briefing

Please note that registered participants will receive the details to the webinar upon registration.

For further information, please contact:

Media: Gemma Garkut | Phone: +61 422 040 559 | Email: ggarkut@tyro.com

Investors: Giovanni Rizzo | Phone: +61 439 775 030 | Email: grizzo@tyro.com

Click here to view full media release.

1 This FY24 guidance includes forward-looking statements. Refer below.

2 Gross profit is stated as normalised gross profit, namely adjusted for Bendigo Alliance support fees associated with transition of Bendigo merchants to the Tyro platform. Bendigo gross profit share is not deducted from statutory gross profit but deducted to calculate normalised gross profit.

3 Tyro uses EBITDA as a non-IFRS measure of business performance, which excludes the non-cash impact of share-based payments expense, share of losses from associates, and other one-off costs.

4 EBITDA Margin is measured as EBITDA (including lending and non-lending losses) divided by gross profit (after Bendigo commission).

5 Free cash flow is calculated before changes in banking funds and timing differences relating to net scheme receivables. It is calculated as EBITDA before share based payments adjusted for non-cash items in Tyro’s working capital movements, statutory adjustments (including rent payments) and capital expenditure including internally generated intangibles. Terminal capital expenditure includes both new and replacement terminals.

Forward-Looking Statements: Tyro’s financial expectations and guidance included in this announcement are subject to there being no material deterioration in market or macroeconomic conditions, and are based on a number of key assumptions which may not prove to be correct, or which may change over time, including no lock-downs, no material changes to current business plan and no material change in the regulatory environment. During the ordinary course of business, the Group is exposed to credit risk, operational risk, market risk and liquidity risk. For details on the management of these risks, please refer to the Annual Report including the Financial Report for the year ended 30 June 2023. Certain statements contained in this announcement are forward-looking statements or statements about future matters, including indications and expectations of, and guidance and outlook on, the future earnings, financial position and/or performance of Tyro. These statements are based on information available as at the date of this announcement, and involve known and unknown risks and uncertainties and other factors (many of which are beyond the control of Tyro). No representation is made or guarantee given that the occurrence of any of the events expressed or implied in these statements will actually occur. Actual future events may vary from these forward-looking statements and it is cautioned that undue reliance should not be placed on any forward-looking statement.

About Tyro

Tyro is a technology-focused and values-driven Group providing Australian businesses with payment solutions and value-adding business banking products. The Group provides simple, flexible, and reliable payment solutions as a merchant acquirer, along with complementary business banking products. More than 68,500 Australian merchants chose to partner with Tyro at 30 June 2023. The Group processed $42.6 billion in transaction value in FY23 and generated $193.2 million in normalised gross profit, originated a record $149.7 million in loans and held merchant deposits totaling $92.7 million. Tyro is Australia’s fifth largest merchant acquiring bank by number of terminals in the market, behind the four major banks.

The business was founded in 2003 with a goal of being the most efficient acquirer of electronic payments in Australia. Tyro has a track record of innovation, creating purpose-built solutions and being first to market. This approach saw the company become the first technology company to receive an Australian specialist credit card institution licence in 2005. In 2015 that licence was replaced by the award of an Australian banking licence, making Tyro the first new domestic banking licensee in over a decade.

Payments are at the core of Tyro’s business, using its proprietary core technology platform to enable credit and debit card acquiring. This offering is enhanced by features purpose-designed for those merchants who choose to partner with the company, including Point of Sale systems integrations, least-cost routing (Tap & Save) and alternative payment types such as integrated Alipay. While traditionally focused on in-store payments, Tyro has recently expanded into eCommerce. Further, Tyro provides value-adding solutions to its partners, such as loans in the form of merchant cash advances and fee-free, interest-bearing merchant transaction accounts.

Tyro has a team of approximately 600 employees, with ~80% of team members working in Technology, Solution, Design and Delivery and Growth teams, focused on delivering solutions for our customers.

Get the help you need

Get the help you need