The Best Restaurant POS: Why Tyro’s Integrated EFTPOS Solution Stands Out

11 November 2016 - 2 min read

General

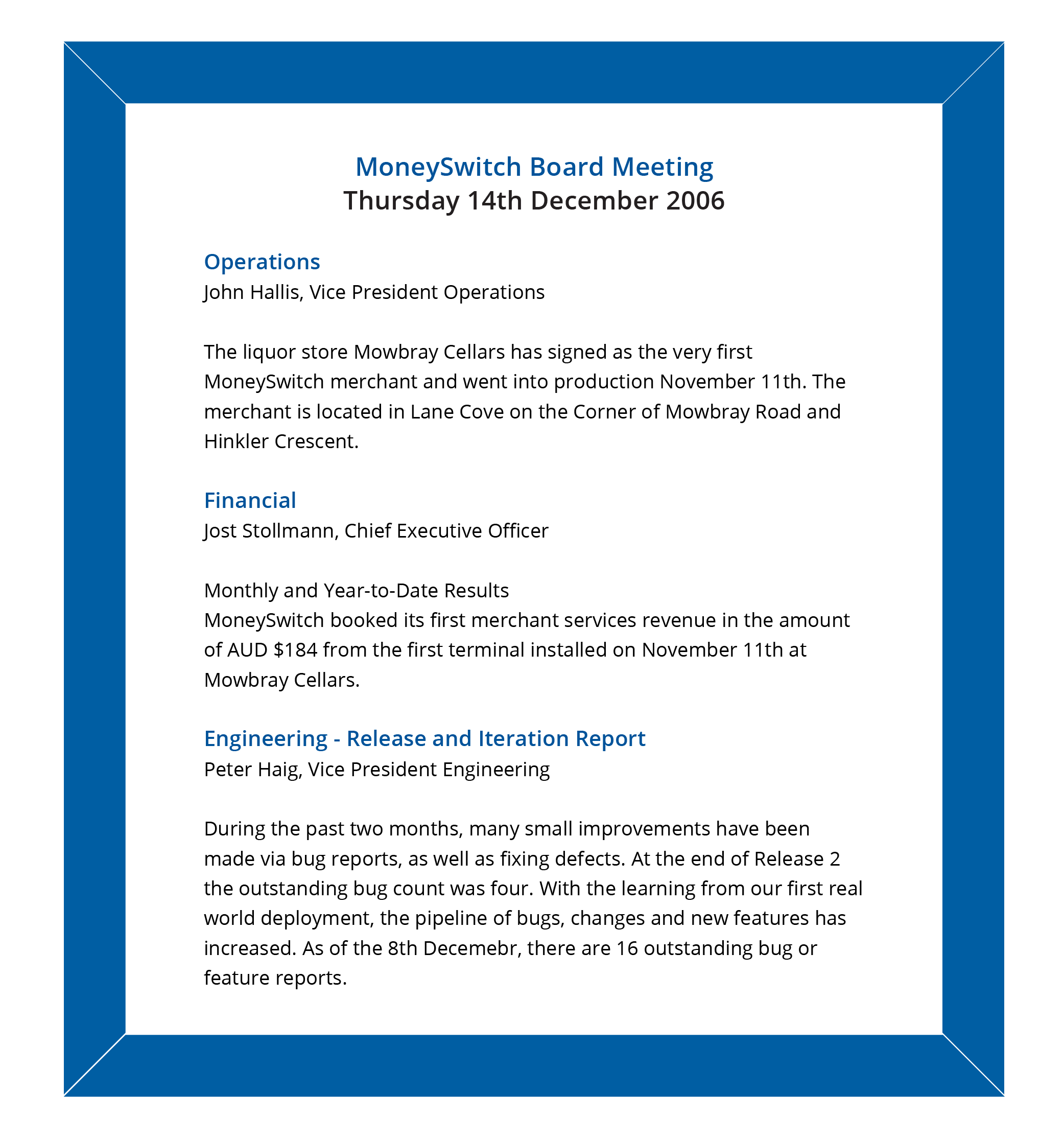

TEN YEARS AGO today, Tyro (the company formerly known as MoneySwitch) processed its first live transaction of $184 at the liquor store Mowbray Cellars in Lane Cove.

In an email I wrote at the time: “After spending years battling our way into the heartland of the banking community, we went live with our first Merchant on November 11th. So, we are no longer a pre-revenue company. We are installing fully functional IP Acquiring Devices with selected Friends & Family – slowly scaling up – proving that our Australian home grown, world-first, end-to-end credit and debit card acquiring solution works.”

It all had started with three Australian tech entrepreneurs, who had sold their prior company to Cisco and had come back to Sydney looking for something new to do. They hatched out a plan to start a new bank, as it turned out.

The opportunity that they spotted arose out of the then Governor of the Federal Reserve Bank Ian McFarlane having become frustrated with the behaviour of the big banks lacking innovation and stifling competition. The RBA created a bank licence and access regime to attract non-banks into the payment space. Nobody applied, but our three tech entrepreneurs.

They brought EFTPOS into the internet age while incumbent banks suffer from the cost and limitations of legacy systems. The business plan drawn up in January 2003 foresaw four phases of investing a total of $1.8 million and reaching break-even in June 2005.

The vision was to “be the most efficient acquirer of electronic payment transactions in Australia, providing innovative service, functionality and value. The product stems from the innovative use of new technology, but the key product differentiator is the integrated services that enable merchants to manage their businesses better.“

22 November 2004, I was offered to become the CEO. On 11 November 2006 we started processing live EFTPOS transactions through the internet.

Today Tyro serves 17,000 Australian small-to-medium companies with integrated payments and banking solutions. We are building the nextGen bank providing frictionless banking and access to unsecured cashflow-base lending.

Happy Birthday Tyro!

You may also like

5 May 2025 - 2 min read

4 Apr 2025 - 2 min read

3 Apr 2025 - 2 min read

26 Jul 2024 - 3 min read

Australian-based 24/7 support