Mastering Cash Flow This Festive Season

26 July 2024 - 3 min read

Business Strategies

We get it, running a business is never easy. One minute you’re juggling invoices, the next you’re tracking expenses, and in between that, trying to stay on top of cash flow. It can often feel like you’re constantly chasing your tail. Whether you are a sole trader or about to start your business, there’s one big call you can make that could help ease the admin pain: choosing the right business bank account. In this guide you’ll find information that can help you pick the right business bank account, so you can easily split your finances between business and pleasure.

The Australian government’s business advice website says that partnerships, companies, and trusts definitely need a separate business bank account to keep things tidy for tax time. But what about sole traders? For sole traders, a separate business account isn’t mandatory, however, the Australian Taxation Office (ATO) recommends it highly. Think of it like a financial divider – it keeps your business income separate from your personal expenses, making record-keeping easy. Plus, there are other benefits to unlock:

Big financial picture: A business bank account makes record-keeping easy. You can track income, keep an eye on expenses and reconcile transactions, so you know how your business is going in near real-time.

Tax time saviour: Help take the stress out of tax time. A separate account makes it easy to identify and track business expenses, streamlining the filing process, saving you time and maybe even some cash along the way.

Keeping it professional: First impressions matter, especially when dealing with clients and suppliers. Having a business bank account projects a sense of professionalism and trust between you and your customers.

Beyond just storing your money, a business bank account can be a valuable financial management tool. Here’s some key features to look for when choosing one for your business:

Be aware of bank fees: Business bank accounts can come with a range of fees, including monthly account fees and transaction fees. These fees can vary depending on the provider. When reviewing your options make sure you compare the fee structure carefully and if there’s a minimum balance you need to hit. Here at Tyro, we offer business bank accounts that are fee-free and even let you earn interest on your balance.

Customer support: Maybe you have a question about a transaction, or you need help with navigating a new feature on your bank’s mobile app – that’s where customer service comes in. Look for a bank that prioritises excellent customer support, with a knowledgeable team that’s available to answer your questions and resolve any issues quickly and efficiently.

Features and functionality: Business bank accounts have evolved way beyond just storing your money. Today, many providers offer a suite of features designed to streamline your finances and free up your time to focus on what matters most – running your business. Below are just some of the ones that many small businesses owners love:

Accounting software: Streamline your bookkeeping by choosing a bank account that integrates seamlessly with popular accounting software. This can help you to cut down on admin and reduce errors and saving time by eliminating the need for manual data entry. If you have a Tyro Bank Account you can link your account to Xero for faster reconciliation, scheduling of batch payments and even payroll.

Invoicing on the go: For service-based businesses, generating and sending invoices quickly can be crucial. Look for an account with built-in invoicing tools or integration with invoicing software. This allows you to send professional invoices from your phone or computer, get paid faster, and improve your cash flow.

Mobile app functionality: Many small business owners don’t have ‘business hours’ in the traditional sense and neither should your banking. Choosing a bank account that comes with a smart, user-friendly mobile app is critical, because it means you can easily check your balance, approve payments, and make mobile deposits anytime and anywhere.

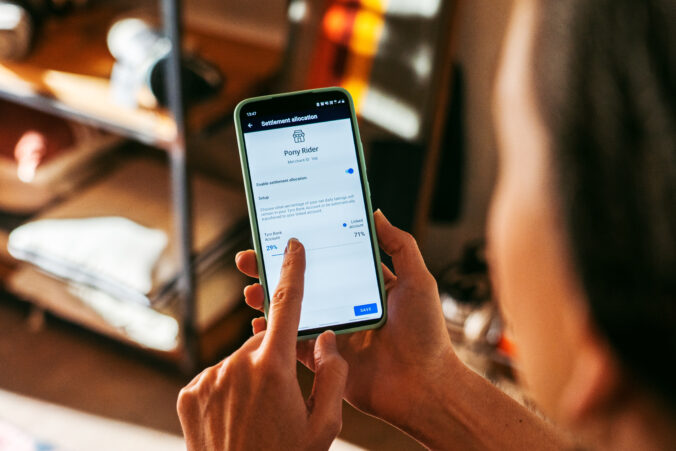

Daily settlements of your EFTPOS takings: Imagine the convenience of having that day’s EFTPOS takings deposited directly into your account each night. Having faster access to your funds helps with operational needs like restocking and payroll. Tyro’s 7-day settlement allows you to receive your takings every day of the week at a time that suits you (between 8pm and 5am), including weekends and public holidays.

Now that you’re armed with this knowledge, we hope we’ve made it a little bit easier for you to compare different business bank accounts. At the end of the day the best option for you will be the one that works best with your own business and empowers you to achieve your business goals.

At Tyro, we’re all about making business banking simple. We offer a powerful EFTPOS solution that seamlessly integrates with our business bank account, giving you real-time visibility of your finances. We can even help with business loan options to fuel your growth. So, ditch the financial frustration and level up your business with a bank account that keeps things simple and helps you focus on what you do best – running your business!

Disclaimer: Tyro Payments Limited ACN 103 575 042 AFSL 471951 (Tyro) is the issuer of its own financial products. As Tyro does not take into account your personal circumstances, please consider if these products are suitable for you. T&Cs available at tyro.com. You can contact Tyro on 1300 00 TYRO (8976) or tyro.com/support/ and access Tyro’s dispute resolution process at tyro.com/complaint-resolution-process/

You may also like

Australian-based 24/7 support