Make your business work better

Team up Tyro EFTPOS with a fee-free Tyro Bank Account for a seamless business banking experience.

Team up Tyro EFTPOS with a fee-free Tyro Bank Account for a seamless business banking experience.

Managing cash flow and streamlining payments is the bread and butter of any successful business. Pair your Tyro EFTPOS with a Tyro Bank Account today.

We work over the weekends and public holidays too. Settlements into a Tyro Bank Account are paid 7 days a week — even on public holidays.

With no fees, and all the perks of earning interest on your balance, doing business with a Tyro Bank Account has never been better.

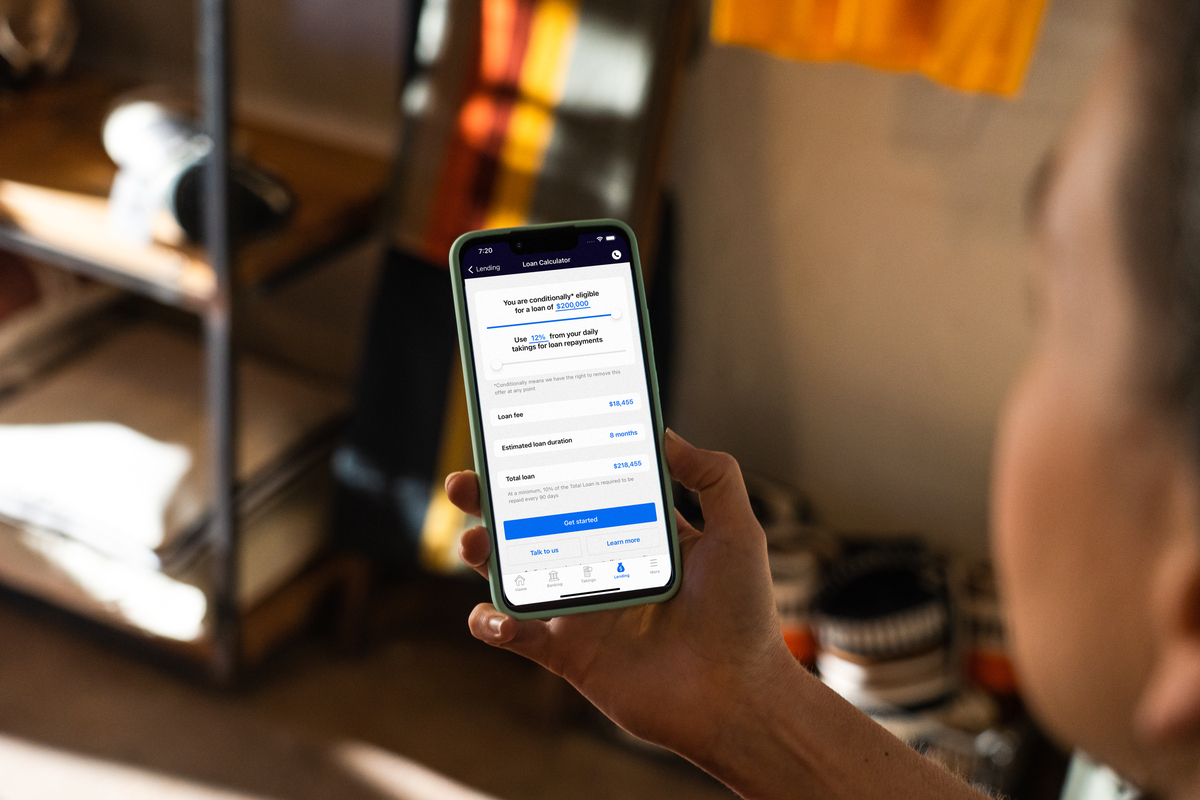

With a Tyro Business Loan2 you get access to fast, flexible funding3, so you can manage your cash flow, take on new staff, or upgrade your equipment.

We use Tyro at 5 locations and barely ever have any trouble.

Integration works seamlessly with our POS, plus I love the free bank account. No monthly fees, no transactions fees and it pays interest.

It also integrates seamlessly with our accounting software making pay bills and payroll effortless! Highly recommend.

I love tyro. It always helps me when I need it.

Easy loan process. No hassle repayments and helped my business get through the tough times.

We have been with Tyro for several years and have had great service at all times, the system outages have been very low.

The loan offers are a great feature with the percentage of takings per day used to pay back the loan in minimal time is great for cashflow when needed.

The whole system is very user friendly. I recommend Tyro to everyone in business.

Quick cash boost? Product restock? New team member? A Tyro Business Loan can be a smart and super quick way to fund the essential things you need to keep your business humming.

Just give a personal guarantee and accept your loan in the Tyro App or Tyro Portal, and you’ll see funds in your Tyro Bank Account in less than 60 seconds or within a few business days into your linked bank account3. In some instances we may require more information to complete your eligibility check.

A Tyro Bank Account comes with more valuable features to help power your business forward.

By linking your Xero Accounting software to your Tyro Bank Account you get access to integrated bank feeds providing seamless reconciliation.

You can choose to automatically transfer a percentage of your daily takings to your external linked bank account, leaving the remainder in your Tyro Bank Account to earn interest.

Have peace of mind knowing your deposits are protected under the Financial Claims Scheme up to $250,000 per account holder.5

Our EFTPOS solutions have got you covered

whether you’re taking transactions in-store or on the go.

Start accepting in-store & online payments with Tyro EFTPOS

Manage your cash flow with our banking solutions, business lending and more.

Fletcher Kidd, owner of eight Just Cuts salons, puts his trust in Tyro EFTPOS. “Tyro’s integration with our system has allowed my business to minimise manual entry” and “We’ve still been able to use tap and pay” when an internet service provider has gone down.

Yes. The Tyro Bank Account and Tyro Business Loan are only available to Tyro EFTPOS or eCommerce customers.

Once your EFTPOS application is submitted and has been approved, you should receive your EFTPOS machine(s) in 3-5 business days (metro areas). Tyro BYO App requires no hardware to be delivered and can be up and running once your application has been submitted and approved.

To apply for the Tyro Bank Account, you will need to have a Tyro EFTPOS or eCommerce solution and download the Tyro App. Once you have the Tyro Bank Account, you are then eligible to apply for the Tyro Business Loan.

Yes. The Tyro Bank Account is completely fee-free. No set up fee, no account keeping fees and no transfer fees.