Murray Inquiry to save the poor $500m in bank fees

Up to 10 million lower income Australians will save up to $500 million a year in unnecessary credit and debit card fees, under changes recommended by the Murray Financial Services Inquiry.

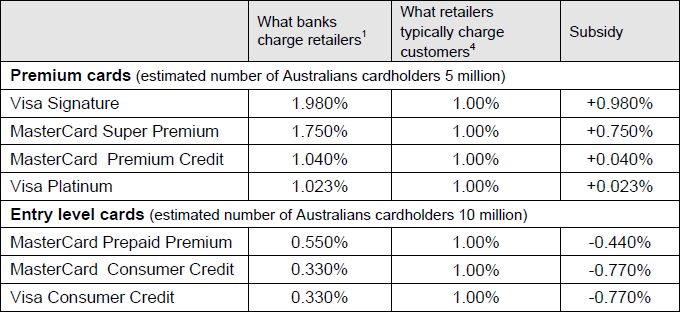

A key finding of the Murray Inquiry is that a hidden practice of the country’s largest banks be banned, where poorer Australians subsidise cheaper air travel, holidays and fine wine for the rich. Analysis of the annual $230 billion credit and debit card spend shows Australia’s 10 million standard card users pay about $50 each to support the five million premium and platinum cards[1],[2] usually held by the rich.

“Premium credit cards attract a range of benefits such as air travel, overseas holidays and other lifestyle advantages. “About 10 million Australians have a standard credit or debit card, and they pay about $500 million per year, or $50 each, in extra fees to subsidise the lifestyles of five million richer Aussies with a premium card,” Tyro Payments CEO Jost Stollmann said.

“This is because retailers typically charge customers a standard 1% rate irrespective of what type of card is used. But banks charge retailers much higher fees for premium and platinum credit cards than standard cards used by lower income people. Effectively, this means the poor are subsiding the rich. This is unfair, unjustified and unAustralian. Credit cards are now the great divider in our society. Banks get away with it because most people don’t know it is happening. Their secret is out now.”

“The Murray Inquiry recommends that hard caps be placed on what banks can charge in credit card fees.” According to a Reserve Bank of Australia (RBA) submission to the Financial System Inquiry, “individuals in the highest income quartile are six times more likely to have premium cards than low income individuals” [3].

Table 1: Premium and entry level card charges and ‘subsidies’

Stollmann said hidden bank fees[5] on credit and debit cards were up to 10 times higher for small businesses[6] than big retailers and 6.7 times [2] higher for low income consumers than high net worth individuals.

“Tyro estimates that small businesses [7] have to pay $300 million more in hidden fees for Visa and MasterCard purchases than the big retailers,” he said. “This is a dramatic injustice and it is getting worse. Why should lower income Australians and small businesses fund the generous reward programs of platinum and super premium cards for the wealthy?”

“Australia’s 390,000 small and medium sized businesses (SMEs) employ more than seven million Australians and are the engine of jobs growth in this country, yet they are having to compete with financial lead in their saddle bags, courtesy of our major banks. These charges are essentially invisible to the average customer. They are unfair. The best option is to ban these interchange fees altogether.”

New Zealand and Canada have mandated that zero interchange fees should apply to their entire EFTPOS network for all debit cards. Likewise, the European Commission lowered cross-border interchange fees to 0.2 percent for debit transactions and to 0.3 percent of credit transactions.

[1] Reserve Bank of Australia figures show Australia has 15.6 million credit and charge accounts

[2] Tyro Payments $6.5 billion in payments per year show 34% of payments are by premium cards and 66% are by standard cards

[3] Supplementary Submission to the Financial System Inquiry August 2014

[4] Assumed surcharge or general price increase

[5] Interchange fee is charged by the card holder’s bank to the business’ bank and then passed on to the business as part of the merchant service fee and then to consumers as surcharge or in general prices.

[6] Visa: Strategic Merchant Program rate 0.22% versus High Net Worth Qualified rate 2.20% and Standard rate 0.33% MasterCard: Strategic Merchants rate 0.25% versus Consumer Elite rate 2.20% and Consumer Standard rate 0.33%

[7] Comparing the lower and higher quartiles of the yearly $230 billion in Visa and MasterCard purchases.

Need to know more?

For more about this news story please contact:

Monica Appleby, Head of Corporate Communications on 0466 598 946 or mappleby@tyro.com

Sophie Cotterill, Corporate Communications Manager on 0414 960 292 or scotterill@tyro.com

Get the help you need

Get the help you need