MORE TAPS, LESS FEES WITH TAP & SAVE

Tap & Save could save your business money by reducing the cost of contactless transactions.

Tap & Save could save your business money by reducing the cost of contactless transactions.

Tap & Save 1 is essentially Tyro’s version of least-cost routing, where eligible debit card contactless transactions are processed through the cheapest network, saving you more on merchant fees.

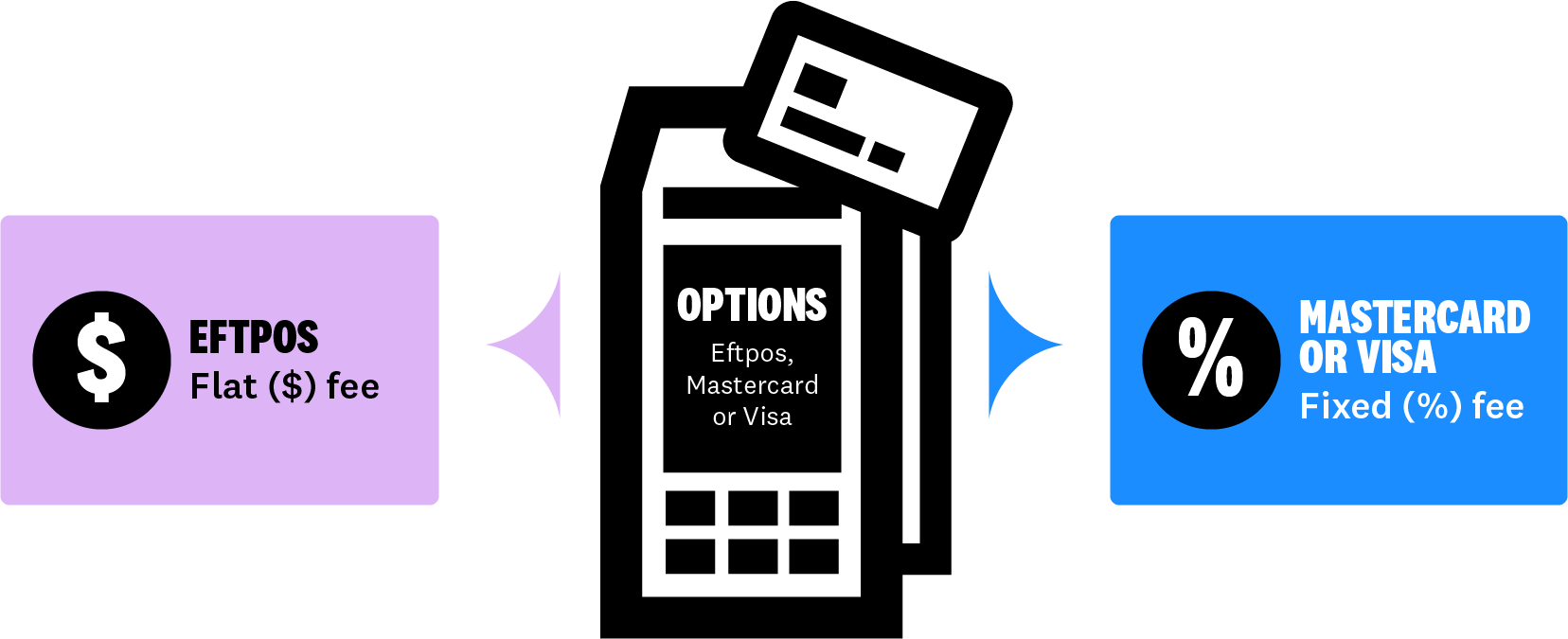

Whenever a business accepts an electronic payment through an EFTPOS machine, they pay a merchant service fee to make the transaction happen. Transactions are either processed through a flat fee via EFTPOS or a fixed percentage fee via Mastercard or VISA.

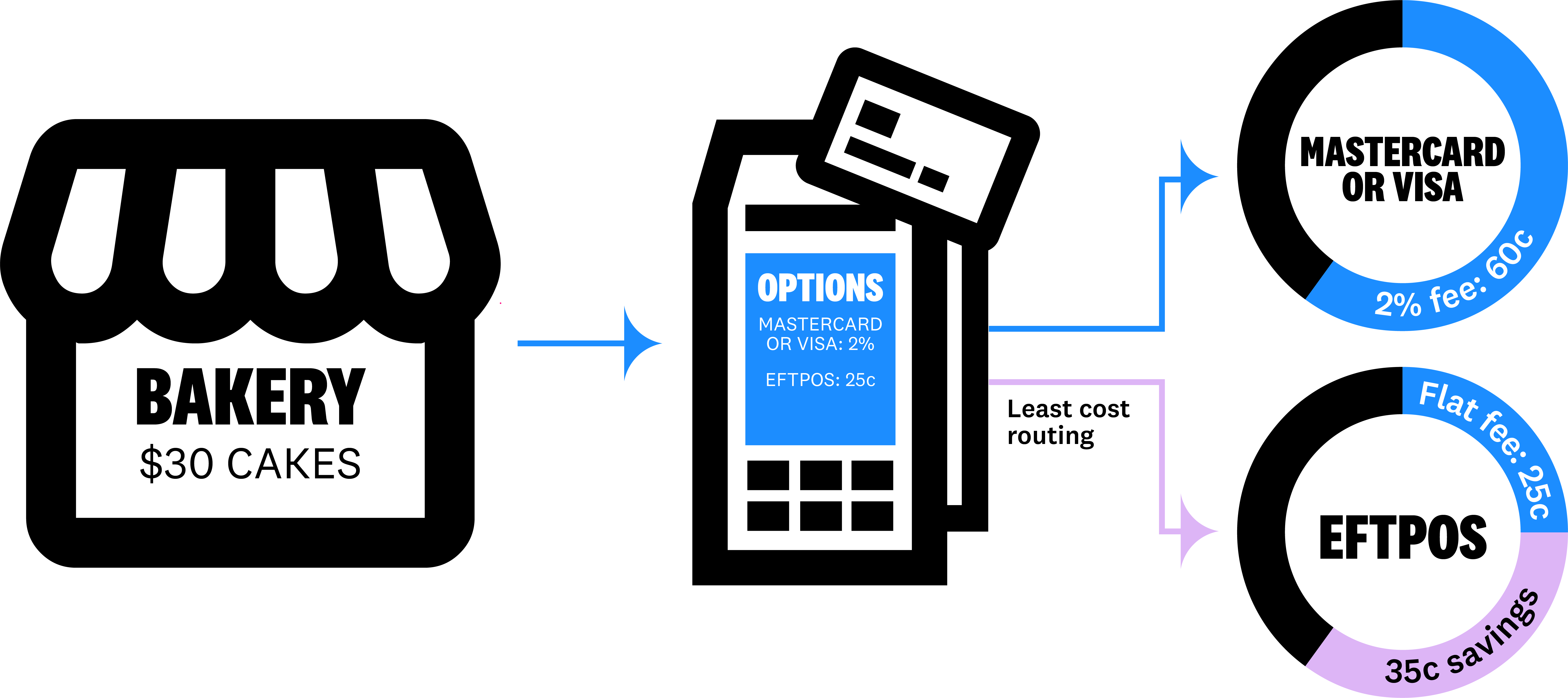

Least-cost routing helps keeps these costs down, by processing eligible contactless debit card transactions through the cheapest network.

Let’s say you own a bakery, and a customer pays for a $30 cake with their contactless debit card. If the EFTPOS flat fee is 25 cents, and the debit scheme transaction rate is 2%, routing this purchase through the original scheme would cost your business 60c. However, with Tap & Save , this would only cost you 25c – saving you 35c in that transaction.

The savings you may receive from Tap & Save will vary depending on your business and mix of contactless payments you process.

You can view your total volume of card transactions by card type and average transaction amount and fee breakdown for any given month in the Tyro Portal in the “Costs” section, under “Cost of Acceptance”.

Contact our local Aussie support team on 1300 00 8976 to understand if Tap & Save is right for you.

Cut your ongoing costs through least-cost routing 1.

Just contact our local Aussie support team on 1300 00 8976 to apply.

Automatic one-time set up, means zero disruptions to your business.

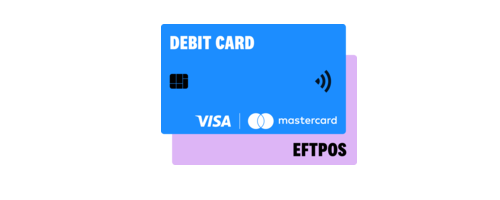

Eligible transactions are contactless (tap-and-go) dual-network debit cards, which can be used to make transactions through EFTPOS or a debit card, issued by your bank. These can be identified by having both the EFTPOS logo on one side, and the Mastercard or Visa logo on the other.

If you want to apply for Tap & Save 1, contact our Aussie support team on 1300 00 8976.

There is no difference between the security of EFTPOS , Visa, or Mastercard transactions, and EFTPOS transactions are also covered by chargeback rights. There isn’t any increased fraud risk associated with Tap & Save transactions.

Our Dynamic Surcharging feature supports surcharge amounts being applied to Visa, Mastercard, American Express, UnionPay, and EFTPOS transactions. This means that if your transaction is routed through EFTPOS , and through Tap & Save, the surcharge rate you have set will still be applied.