Up to 10 million lower income Australians will save an estimated $500 million a year in unnecessary credit card fees, under changes being considered by the Reserve Bank of Australia (RBA).

In the current review of card payments, the RBA is considering imposing lower and hard caps on so-called ‘interchange’ fees that banks charge each other for the use of credit and debit cards.

Lowering the interchange fee on credit cards from an average of 0.5% currently to a hard cap of 0.3%, as foreshadowed in the RBA 2007-08 Review and as legislated in the European Union, would liberate Australians of estimated bank fees of $550 million and possibly hundreds of millions more p.a.[1]

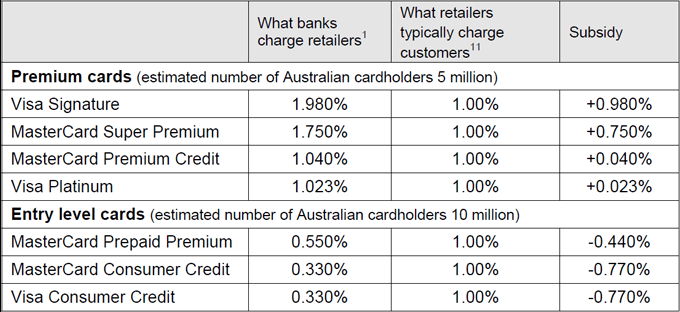

Moving from a hard to an average cap addresses the key finding of the Murray Financial System Inquiry that identified the hidden practice of the country’s largest banks be banned, where poorer Australians subsidise cheaper air travel, holidays and fine wine for the rich.

The RBA Governor Glenn Stevens himself said last week, “when I use my platinum Amex card and get points, someone is paying for that.”[2]

According to the RBA submission to the Murray Inquiry, “individuals in the highest income quartile are six times more likely to have premium cards than low-income individuals”.[3]

Indeed, Australia’s 10 million standard card users pay about $50 each to support the five million premium and platinum cards[4][5] usually held by the rich, according to analysis by Tyro of the annual $230 billion credit card spend.

“Most Australians would be horrified to think that their hard-earned money is subsidising the rich. It’s Robin Hood in reverse, unfair and unAustralian,” Tyro Payments CEO Jost Stollmann said.

The card schemes and banks get away with it because most people don’t know it is happening. Their secret is out now. The RBA itself has said retailers and customers don’t know what they are paying.[6]

Fees for small businesses[7] are up to 10 times higher than for big retailers while low-income consumers pay 6.7 times more than high net worth individuals. And that divide is only widening, according to the RBA.[8]

“Tyro estimates that small businesses[9] pay $300 million more in hidden fees for Visa and MasterCard purchases than the big retailers,” he said.

“Why should lower income Australians and small businesses fund the generous reward programs of platinum and super premium cards for the wealthy?”

“Australia’s 390,000 small and medium sized businesses (SMEs) employ more than seven million Australians and are the engine of jobs growth in this country, yet they are having to compete with financial lead in their saddle bags, courtesy of our major banks.

“These charges are essentially invisible to the average customer. They are unfair. The best option is to ban these interchange fees altogether.”

In a submission to the RBA Review [10], Tyro argues that the interchange fee must be set at ZERO, already because the schemes and issuer banks have removed transparency and choice.

Getting rid of the interchange fee eliminates regulatory complexity, the unfair cross-subsidies, the vexing surcharging (reversing interchange), barriers to innovation and catapults Australia into the cashless society.

Australia is falling behind other jurisdictions. New Zealand, Canada and eight EU member states with high card issuance have very low or zero debit interchange fee.

[1] $450 million in fees on $225 billion in credit card transactions through a 0.2% lower cap, estimated $100 million through elimination of the creep between reviews and potential hundreds of additional millions through the inclusion of companion charge cards.

[2] As reported in the Australian Financial Review

[3] http://www.rba.gov.au/publications/submissions/fin-sys-inquiry-201408/pdf/fin-sys-inquiry-201408.pdf

[4] Reserve Bank of Australia figures show Australia has 15.6 million credit and charge accounts

[5] Tyro Payments $6.5 billion in payments per year show 34% of payments are by premium cards and 66% are by standard cards

[6] RBA Review of Card Payments Regulation (March 2015)

“Cardholders may not face the correct price signals associated with their choices, which is likely to result in cross-subsidisation.”

[7] Visa: Strategic Merchant Program rate 0.22% versus High Net Worth Qualified rate 2.20% and Standard rate 0.33%

MasterCard: Strategic Merchants rate 0.25% versus Consumer Elite rate 2.20% and Consumer Standard rate 0.33%

[8] For both debit and credit cards, the tendency has been for the differences in interchange fees applying to the two groups (small and large merchants) to have widened significantly since merchant specific rates were introduced. RBA Review of Card Payments Regulation (March 2015).

[9] Comparing the lower and higher quartiles of the yearly $230 billion in Visa and MasterCard purchases.

[10] http://tyro.com/content/uploads/2015/05/Submission-Review-of-the-Card-Payments-Regulation-2015-04-24.pdf

For more about this news story please contact:

Monica Appleby, Head of Corporate Communications on 0466 598 946 or mappleby@tyro.com

Sophie Cotterill, Corporate Communications Manager on 0414 960 292 or scotterill@tyro.com

Australian-based 24/7 support