Tap to Pay on Android – take payments anytime and anywhere

15 February 2018 - 15 min read

Product Features

When a small business is doing an EFTPOS comparison to find out what suits their business…

It can be a real hassle…

Let’s break it down.

The various EFTPOS machines can be difficult to distinguish from each other…

They all look and feel quite similar.

You might be tempted to run with the best looking EFTPOS machine or just turn to your current personal bank to avoid the inconvenience and confusion involved in the decision process.

You just want something that works for once.

Research suggests that the majority of small to medium businesses are significantly less aware of business banking and EFTPOS outside of the big 4 in Australia.

Although most businesses have specific requirements for their EFTPOS machines based on their POS/PMS integrations & specific industry needs (e.g. tipping, health fund claiming) – up to 45% of businesses go with their primary business bank due to proximity and the fact it was the first business bank they dealt with.

There is clearly a void in useful resources that can help you reliably select an EFTPOS machine that suits your business.

That’s why we’ve summed up what EFTPOS features you should consider when selecting or switching your EFTPOS machine.

Source: RFI Research – Australian SME Banking September 2017

Let’s get started…

If you do not have a Point of Sale (POS) now, no need to worry about this point.

If you do, read on.

For those that are unsure what a Point of Sale (POS/PMS) is, it’s basically the software merchants use to conduct and track sales with their customers.

A Point of Sale is the software merchants use to conduct sales.

Here’s another definition…

Source: http://www.businessdictionary.com/definition/point-of-sale-software.html

It could be a cash register…

It could be a computer…

Or even an iPad.

A POS is used to manage inventory, tally costs and conduct financial transactions.

As the technology for POS systems becomes more advanced, small businesses are moving away from traditional POS systems toward cloud based POS solutions…

Here’s what a typical cafe POS might look like

Many small businesses are also ensuring their POS is integrated with their EFTPOS provider…

The key takeaway here is to select an EFTPOS provider with superior integration technology that can seamlessly integrate with your Point of Sale.

Here’s why:

Want to learn more about integration? Read more here.

No one wants an umbrella with holes in it…

What you are looking for is an EFTPOS solution that:

An example of a data centre

Find out more about connectivity here.

Selecting an EFTPOS machine that’s bespoke to your business makes life easier.

Easier for your customers.

Which makes it easier for your business.

If you own a bar, you’d want to be able to set bar tabs.

Hopefully as a merchant your receipt is this long!

Source: http://www.worldofbuzz.com/wp-content/uploads/2017/05/34562682006_d0e64021bf_c.jpg

If you’re a physiotherapist you would benefit from integrated health fund claiming.

And so forth…

It’s hard to keep track of what features are cutting edge in your industry when doing an EFTPOS comparison…

So we’ve put them below.

| Primary Health | Allied Health | Hospitality | Retail |

|

Integrated with Medicare Easyclaim 1 Fast rebate payment 1 Multiple doctor & account capabilities |

Integrated Health Fund Claiming 1 98% coverage of the insured population 27 PMS integrations with HealthPoint |

The ability for customers to pay from their table Split bills 2 Tipping 2 Currency conversion Ability to setup bar tabs 2 Ability to process transactions simultaneously |

Pay from the comfort of a chair |

Time is money – Benjamin Franklin.

Small businesses don’t have time to spend their time with confusing manuals and tricky wires.

What you want is something quick and simple to set-up, so you can focus on what is important.

When searching for an EFTPOS machine you should check what the set-up process is.

Here’s a checklist:

| 1. | Is it easy to unpack? | ☐ |

| 2. | Does it include an ethernet cable? | ☐ |

| 3. | Is the EFTPOS machine easy to position for the customer? | ☐ |

| 4. | Are the cables long enough? | ☐ |

| 5. | Is there a simple set-up guide? | ☐ |

| 6. | Are the instructions clear? | ☐ |

| 7. | Is there a seamless experience with connectivity to your Wi-Fi or 3G? | ☐ |

| 8. | Is the password set-up intuitive? | ☐ |

| 9. | Is it easy to hook up with your POS/PMS? | ☐ |

| 10. | Is it simple enough to customise settings? | ☐ |

| 11. | Do the instructions cover set-up of functionalities such as pay at table and tipping? | ☐ |

| 12. | Is there a policy for EFTPOS machine damage? | ☐ |

| 13. | Is it obvious how to get additional EFTPOS machine paper? | ☐ |

| 14. | Is it clear how the reporting system is set-up? | ☐ |

If you’re a small business, you don’t have time to deal with difficult processes and unclear instructions.

What you want is something quick and simple to setup, so you can focus on what is important.

Speed means queues move faster…

Queues moving faster means your customers are happier….

I’ll sum up the result in the following, highly technical equation:

Happy customers + fast moving queues = more sales.

If you’re looking for a guide on how fast transaction speeds should be, we recommend you find an EFTPOS service that processes transactions that does not provide any friction in the payment experience. Tyro processes transactions on average of 1.6s with a Tap & Go transaction.

Some people want to keep their card details secure and put in a PIN, but most will just tap and go.

When doing an EFTPOS comparison, we highly recommend you consider the speed of the EFTPOS machine in question.

Speed is important…

Changing your EFTPOS is one thing.

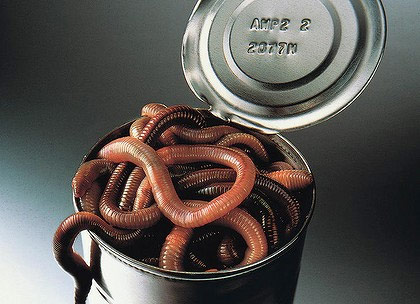

But having to change all of your bank details over could be a whole other can of worms…

A can of worms you want to avoid.

It’s nice to have the option if you’re actually looking for a new bank but, if not, this might be an inconvenient extra step that could cause you a lot of administrative pain and delayed phone calls.

When switching EFTPOS, make sure you double check whether your bank can integrate with your new EFTPOS or whether you have to change – you might save yourself a lot of time.

The can of worms that can be involved with having to transfer your bank and EFTPOS unwillingly.

When you’re accepting payments, you’re placing a lot of trust in your EFTPOS provider to maintain safe payments, avoid fraud and keep data encrypted.

To protect you and your customer’s money, you should ensure that the EFTPOS system you decide to go with offers the following features:

You need an effective firewall between you and online hackers. A firewall is essentially a network security system that monitors and controls incoming and outgoing network traffic based on predetermined security rules. When you enquire for your next EFTPOS, make sure this is available.

PCI PTS are technical and operational requirements set to protect cardholder data. The standards apply to all organisations that store, process or transmit cardholder data. Make sure you check with the payments provider that their EFTPOS machines are PCI PTS compliant.

Check with your EFTPOS solution provider that they do not share cardholder data with the Point of Sale and ultimately with the merchant. Bonus points if this information is encrypted.

Protecting cardholder data is vital. If fraudsters get their hands on the PIN and other authentication data, they can impersonate the cardholder, use the card, and steal the cardholder’s identity. Also make sure that your EFTPOS provider has solutions to deal with MOTO fraud, order refund fraud, third party payments fraud and counterfeit card fraud.

A personal identification number is a numeric or alphanumeric password or code used in the process of authenticating or identifying a user to a system and system to a user. PIN protection on an EFTPOS machine is an additional safeguard to fraud.

Interested in security and fraud? Make sure you read more when doing your EFTPOS comparison.

We recommend that, when searching for your next EFTPOS machine, you have multiple ways of connecting to the internet.

A physical cable and the one that you plug in straight from your modem.

Wi-Fi is a wireless technology, it’s the one that you stream from your modem without cables.

3G, standing for third generation, is the third generation of wireless mobile telecommunications technology. This is what you use for your mobile phone. Bonus points if you find an EFTPOS provider that includes the 3G cost in the fee.

Check if the EFTPOS service you’re interested in has 3G backup.

Find out more about connectivity here.

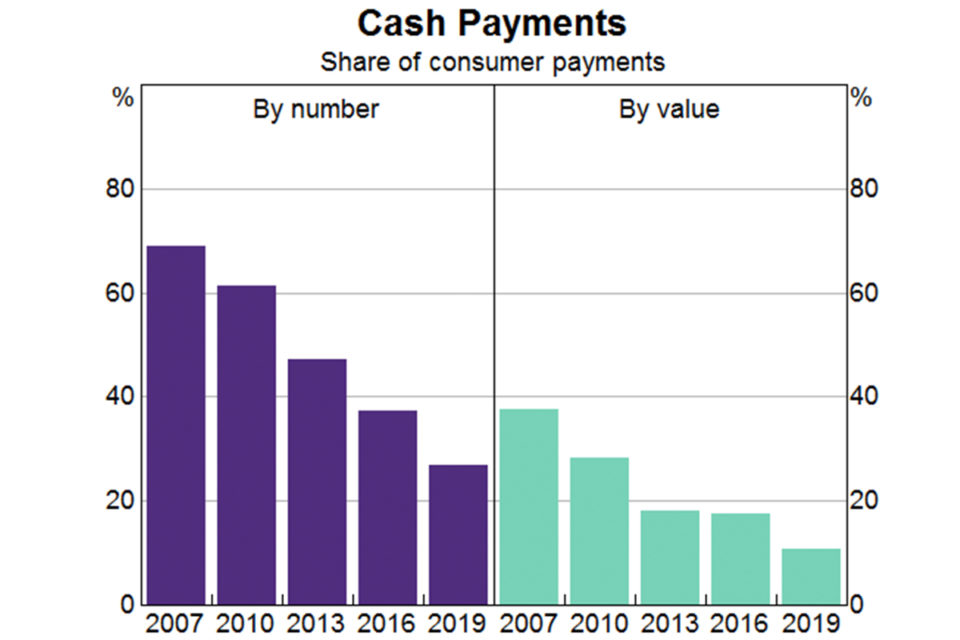

From cards to contactless, the way people are paying is changing and expanding.

Cash is still used.

However, as cash payments decrease over time, alternative payments are on the rise. If you’re not accepting these alternative payments, you’re missing out on business.

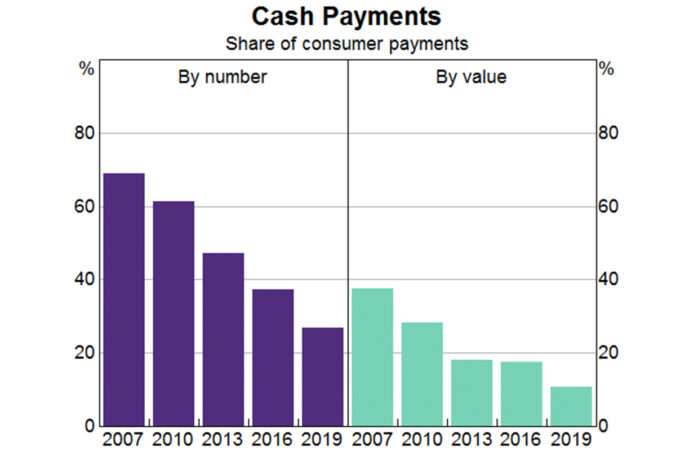

If you look at trends over the last 5 years, you can see use of cash is rapidly decreasing.

Source – https://news.theceomagazine.com/finance/reserve-bank-australia-cash/

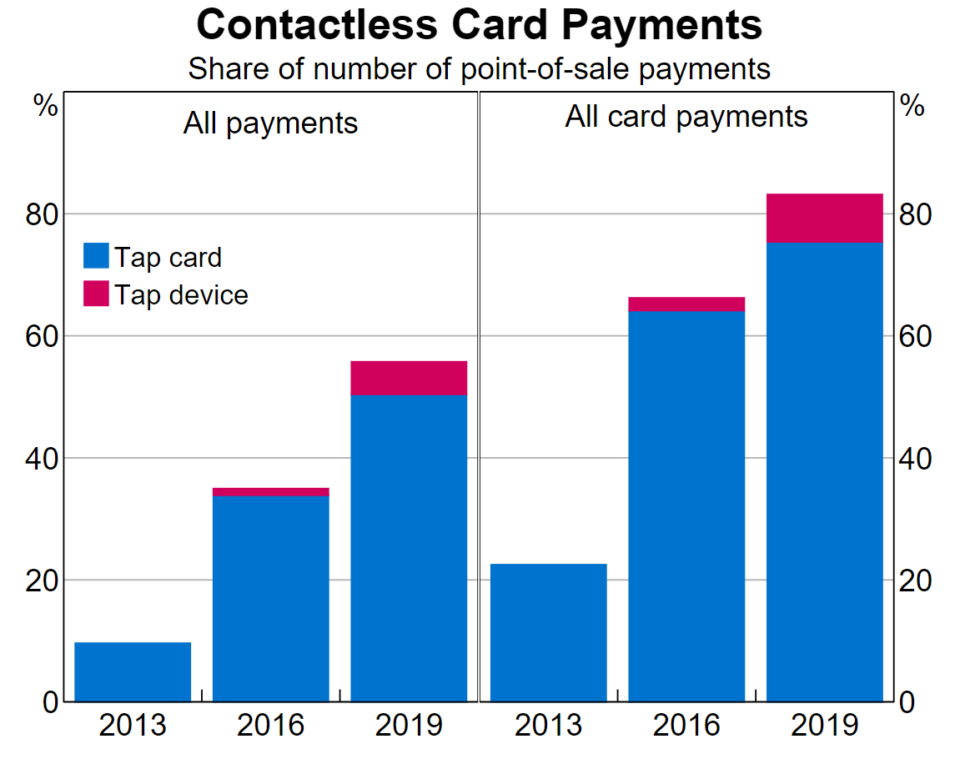

…And contactless card payments are on the rise.

According the RBA, In 2019, debit cards were the most commonly used means of payment, overtaking cash as the single most frequently used payment method

Source: https://www.rba.gov.au/publications/bulletin/2020/mar/consumer-payment-behaviour-in-australia.html

Overall, the more forms of payments you accept, the more business you can generate.

It’s that simple.

Here are some of the payment methods you should consider when selecting your next EFTPOS solution:

This includes all the major credit and debit cards used in Australia – the most common form of EFTPOS payment.

Yes, more and more people are paying with their phones. If you’re not accepting this you could be losing tech savvy early adopter markets.

The way people pay is changing rapidly, you need to be able to accept different forms of payments, otherwise you could lose valuable customers.

Find out more about payment and card acceptance here.

Australia has hit record numbers in the tourism industry…

We welcomed 8.7 million international visitors in the past year, up 7.1% from last year.

Source: http://www.tourism.australia.com/en/markets-and-research/tourism-statistics.html

That means more travelers wanting to pay for things.

These travelers have a friction point, they want to pay with their overseas bank account.

The solution is Dynamic Currency Conversion…

Dynamic Currency Conversion automatically converts the currency from the travelers’ country of residence to Australian dollars ($AUD).

Here are the main benefits of having an EFTPOS that can convert currency…

Find out more how currency conversion could be useful for your business here.

A lot of businesses have crazy hours…

Bars do night shifts.

Grocers do early mornings.

Without EFTPOS support at these times, you might be putting yourself in a sticky situation.

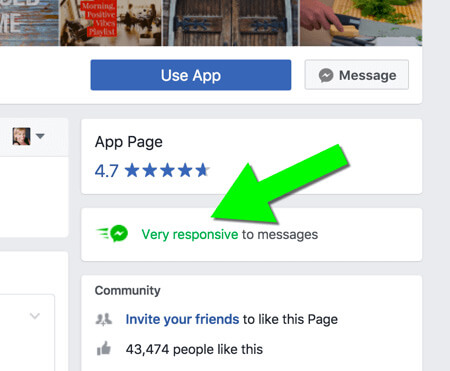

You can check a company’s Facebook page to see how quickly they respond to your messages.

You should be able to tell how responsive a company is by testing their social media response time and call response time.

In a survey by The Social Habit, 32% of social media users who contact a brand expect a response within 30 minutes, and 42% expect a response within 60 minutes

But time is not the only crucial aspect of an EFTPOS providers’ customer support…

A study by Gallup measured how engaged customers felt after getting service at a bank.

While customers who felt that the bank offered speedy service were six times more likely to be highly engaged, customers who gave the bank high ratings on “people” factors (like the tellers’ courtesy and willingness to help) were nine times more likely to be fully engaged.

Another thing you might want to check is how people review the EFTPOS services’ customer service. You can find this on Google reviews, Trustpilot and other rating sites.

Source: https://blog.hubspot.com/marketing/surprising-customer-service-data

You will get some reviews like this.

Source: https://www.productreview.com.au/p/nab-national-australia-bank/2.html

You should be able to decide by these reviews whether the EFTPOS service you’re looking to pursue is reliable.

These EFTPOS reviews should give you some good ideas about what to expect with each EFTPOS service.

When doing an EFTPOS services comparison, we’d highly recommend you check out how the EFTPOS provider deals with customers.

A lock in contract is essentially a contract where you cannot opt out of ongoing payments without paying some sort of penalty making it difficult to switch to another EFTPOS service.

You don’t want that…

It’s also a red flag and could imply the EFTPOS product is not hitting the mark, creating a need for the EFTPOS company to hold it’s customers in contracts.

Make sure you check what your signing up to, are you able to get out of the contract if you decide the service isn‘t up to scratch?

When doing an EFTPOS comparison, check with your EFTPOS provider what fees they have, how transparent they are and whether they are lock-in contracts or not

What should EFTPOS reporting look like?

On a surface level, you want it to be accurate, quick and comprehensive…

We collated a list of EFTPOS features that you should research when looking for an EFTPOS machine.

By monitoring how much you are accepting per day, you can make forecasts and budget your business expenses.

Segmenting transaction data can be useful to identify trends and make adjustments to your business in response. At the least it is important break down payments by what location, what individual EFTPOS machines and at what time of the day your business is receiving the largest fluctuation in cash flow.

Powerful search functionality for individual transactions will help you access card payment transaction breakdown.

Search is an increasingly useful feature to understand the nature of payments in your business

The ability to create and view past invoices, produce reconciliation reports, and see your service fees breakdown gives your business more transparency as to where your money is going.

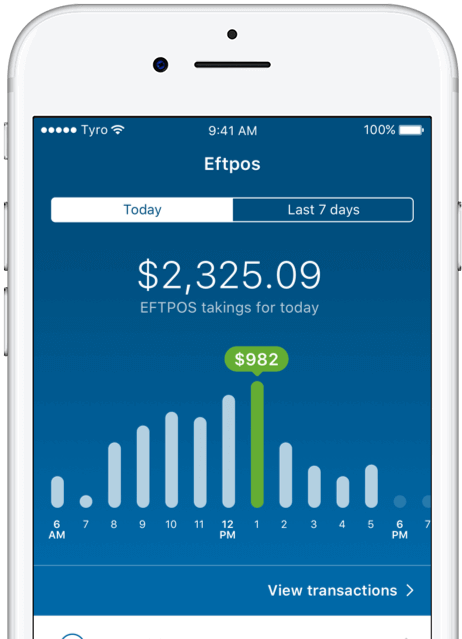

Having digital reports means you can access information from your phone or device without relying on a printer, and manipulate the report as you like. Bonus points if there is a phone app you can log in to.

Mobile usage has never been higher. Increasingly, people are also using mobile apps to check balances of their personal banking and business accounts.

Having access to a mobile app means you can access important information about your business on the go

Here is an example of what a mobile app may look like for your daily EFTPOS takings:

Want to see how a mobile app could be useful for your business? Find out more here.

When researching what EFTPOS suits your business, it’s important to be conscious of the following features, these can determine how effectively your business accepts business:

If you’d like to find more about what EFTPOS features to consider when investing in your next EFTPOS machine, or doing an EFTPOS comparison you can contact us here.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

30 Sep 2024 - 2 min read

26 Jul 2024 - 3 min read

Australian-based 24/7 support