How Tyro Helped Framers Warehouse Frame Success on Sydney’s Northern Beaches

11 April 2023 - 9 min read

Case Studies

You’ve got customers who love you and plenty of new venues coming into the fold.

Meanwhile, your loyalty program is ticking the boxes just fine on many levels. Yet one major challenge remains – your customers keep forgetting to use it.

What this leading hospitality group did next transformed the depth of data at their fingertips and took their customer experience to a whole new level.

“We know that the pub in Australia is a really important community meeting place, and we want to be really engaged and respectful in the communities that we trade in.”

Marianne Mewett, Chief Experience Officer, Australian Venue Co.

Australian Venue Co. (AVC) has grown rapidly across the country over the last six years, from less than 200 venues to more than 200 today.

“With over 200 unique brands, the venues are really centered around their local community and local customer base,” says Marianne Mewett, Chief Experience Officer at AVC.

“We’re very renowned for our vibe and atmosphere, and that comes through in a lot of the customer sentiment data that we get.”

AVC owns and operates iconic pubs and neighbourhood locals, a floating pontoon bar, late night venues, and restaurants. Its properties include The Winery in Sydney’s Surry Hills, WA’s Claremont Hotel, the Regatta Hotel in Brisbane, and a stalwart of live music, St Kilda’s Esplanade Hotel.

To harness this customer engagement across their growing number of venues and geographical spread, AVC built a customer loyalty program and app to offer customers the ability to earn rewards and engage with the venues, wherever they are.

It was a strategy that seemed simple. “We could see that loyalty members spent double and that they visited our venues three times more often”, says Mewett. On paper, loyalty members were very happy customers.

However, member behaviours weren’t translating to real rewards, and the program wasn’t delivering on its potential. Customers were forgetting to open the app and they were not earning points. “That was a big pain point,” says Mewett.

AVC soon recognised that they needed to make improvements and decided to make the leap to develop its own solution.

“It gave us the drive to say, ‘We’re now ready to develop our own solution and be more in the driving seat in terms of product and feature development, and to be able to respond quicker to customer feedback and requests’,” says Mewett.

On their existing program offering, Mewett says, “we were quite restricted in the way we could reward customers. The customer demand for loyalty is that they need it to be quite personalised”.

And so, with the help of a firm called Loyalty and Reward Co, Mewett and the AVC team mapped out a new set of program requirements and approached payments specialists, Tyro, to partner in personalisation.

“Tyro was an obvious partner because we have an existing relationship with Tyro for our EFTPOS needs,” says Mewett. “It was basically going to Tyro to say, ‘Can we link these two things together? Can we make it even more seamless so customers can still earn points even when they forget to open the app?’.”

AVC also had the administrative overload to reign in. “A lot of customers were reaching out to us with receipts to manually add points”, Mewett explains. Plus, there was the question of the ‘new normal’ of QR codes for in-venue menu ordering.

Could AVC deliver one seamless customer experience? It was a question that weighed in more ways than one, with usability of key concern. “The less mental load that we can have on customers in terms of transacting and being a loyalty member, the better,” explains Mewett.

What this future experience looked like was a challenge Tyro’s Head of Digital and Platform, Adam Ayers, was keen to tackle head on for this Tyro customer – reducing that cognitive load, turning repeat customers into fiercely loyal customers, and helping another Australian business tread the path to lasting success.

Ayers saw that the solution would be found in the sweet spot between the customer pain point and the Tyro offering. “It isn’t about the technology we can build, it’s all about the problems that we can solve and how we can create compelling experiences for our merchants and their customers.”

First principles: the customer need

While Mewett and the AVC team had a clear vision for how they wanted the new app solution to unfold, the initial focus for Tyro’s Head of Digital and Platform, Adam Ayers, was clear.

“We always start off with understanding the customer” says Ayers. “That includes AVC as our customer, but we also need to look through the lens of their customers.”

The Tyro approach

Taking a multidisciplinary, iterative approach, the Tyro project team explored the customer behaviours they were seeing in the AVC loyalty program data. From there, they further unpacked the pain points Mewett’s team identified, alongside other opportunities, and carved these into smaller areas of focus again – well before design could begin for the new and improved AVC customer journey.

The approach was driven by Tyro’s guiding principles to product design, ensuring the project could deliver an embedded technology solution AVC customers needed without administrative headache for customers and the business.

Storyboarding the moments of truth

Storyboarding informed a significant part of the process. The team workshopped current state behaviours and future vision must-haves from a user-experience perspective, including:

AVC’s new omnichannel loyalty and payment app, The Pass, is a one stop ordering, payment, and rewards solution. Developed in partnership with payment and loyalty developers EonX, and integration partners Mr Yum and H&L in addition to Tyro, The Pass allows customers to order via mobile and earn & redeem points at the group’s 200+ venues, Australia-wide. Mewett calls it “the most frictionless loyalty possible” and customers can use it at the table, at the bar, and online.

Of their new eCommerce functionality through Tyro, without which “we wouldn’t have a product” says Mewett, the app functions completely through the line. “Everything that’s happening in that app is an eCommerce transaction.”

Single settlements across venues and channels is a significant bonus for their busy finance team. “For a group of our size, streamlining payouts, settlements and reconciliations is a key consideration. We needed to make sure, as we scale, that the efficiency in the back office team remains really solid.”

Says Mewett of the solution, “with the card-linking functionality, it creates another seamless way for customers to engage in the program and to earn their points as well. And on the flip side, it gives us the opportunity to understand their value beyond what they’re spending in The Pass. So, we really have a more holistic view of our member value”.

The Pass experience by Australian Venue Co. and Tyro

Customers can pay in dozens of ways – using a card, using a wallet on their iPhone or Android phone, or through a wearable such as a Fitbit. Although these are all different methods of paying, it’s the same card that is loaded across all these different form factors.

Tyro’s card linking pulls all this data together back to that same card, so the spending behaviour or the buying pattern of that card can be understood.

1. No more forgotten points

AVC’s biggest pain point has been engineered out of the equation. For customers at an AVC venue, whether paying with a card loaded into The Pass app or with that same card directly on a Tyro EFTPOS machine, they still earn loyalty points.

2. Feeling heard

The AVC team took some of its high value members along for the project development journey to ensure their needs were heard. “At the end of the day, what we do is very simple – we ask the customers and the locals what they want out of their local venue, what are we missing or what could we do better,” says Mewett.

3. True member value

AVC needed greater visibility on member spend, and now they have it. Says Mewett, “it gives us a fuller picture of what our valuable members are worth, where they are transacting, and more”. As they move from venue to venue, what they buy and when, and more.

“There is a lot of complexity happening in the background, but for the customer it’s invisible and it just works.”

Adam Ayers, Head of Digital & Platform, Tyro

The success of the Tyro and AVC solution didn’t come from taking a one size fits all approach to payments and rewards. It came from prioritising customer needs and giving them what they want, with less hassle to get there.

As Ayers describes it, this project “brought together several product capabilities we have at Tyro to deliver an innovative customer experience. AVC customers can now seamlessly earn rewards whether they pay using a card at an AVC venue or by using ‘The Pass’ on their phone.”

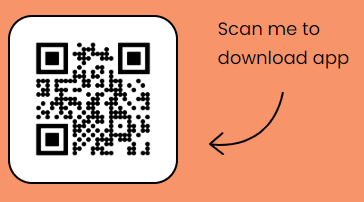

Scan the QR code below. For more info visit thepassbyavc.com.au

Tyro is Australia’s largest EFTPOS provider of all ADIs outside the big four1 and provides tailored EFTPOS, effortless business lending, and banking solutions that support over 61,000 Australian businesses. Beyond credit, debit and EFTPOS card acquiring, Tyro offers Medicare and private health fund claiming where POS/PMS supports integration, and rebating services.

1 As per the statistics detailed in Authorised Deposit-taking Institutions Points of Presence June 2021 issued by APRA in October 2021. Excludes EFTPOS providers who are not ADIs.

4 Jun 2025 - 4 min read

3 Jun 2025 - 3 min read

3 Jun 2025 - 5 min read

Australian-based 24/7 support