How small businesses can use the tax benefits to upgrade their payment tech

23 August 2017 - 3 min read

Business Strategies

What are merchant fees? Several things fall under this umbrella:

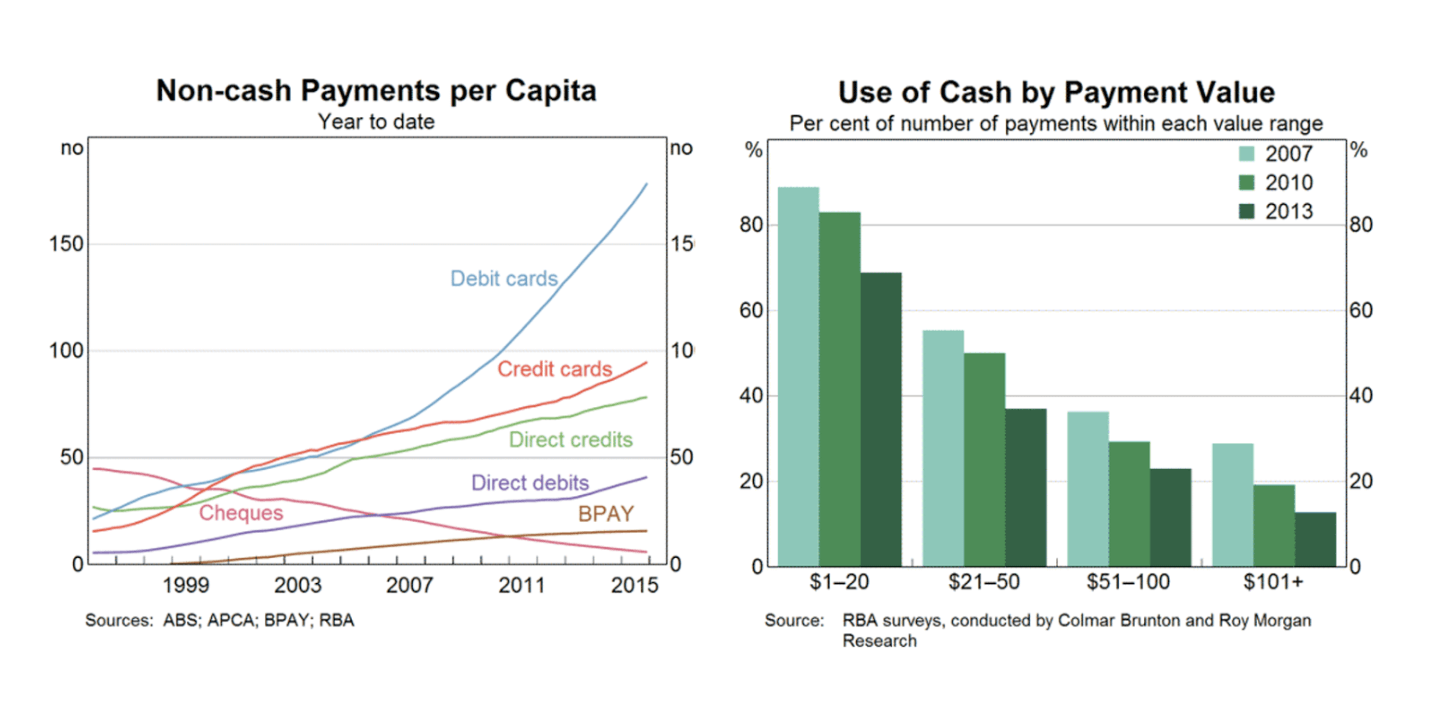

The share of payments made using a credit or debit card has doubled since 2007. This is especially the case when it comes to smaller purchases.

It is becoming particularly important for you to understand the implications that EFTPOS, card-mix and merchant fees have on your margins.

Don’t accept card payments? You’ve probably have had your fair share of walk outs.

Why is offering this flexibility important?

Friction in your payments will spell unhappy customers, and lost business.

Cashless payments have transitioned from trend to standard amongst Australian consumers.

EFTPOS machines let your customers make cashless payments using their debit cards, credit cards and mobile phones.

With taking electronic payments, come merchant fees.

Merchant fees are a necessity when it comes to EFTPOS service offerings, however, you do have options of minimising them and your costs of selling

Businesses have found many ways to pass on the cost of accepting electronic payments to their customers. The most popular of which being surcharging.

“Retailers will be able to surcharge card users”. This sentence breaks it down. Surcharging is where businesses add an additional charge or payment to their customer’s transaction to help cover the cost of processing credit and debit card payments.

2016 saw the RBA knuckle down on excessive surcharging by introducing a ban on fixed dollar surcharges.

This was rolled out in two stages, and was first to hit larger organisations.

The second stage is landing and involves small businesses dropping excessive surcharging fees.

Now enforced, the Australian Competition and Consumer Commission (ACCC) has the power to penalise businesses for overcharging.

This means hefty fines for non compliance.

If you wish to surcharge, you should so within the boundaries of the RBA rules. Tyro can help you surcharge compliantly.

Many Australian businesses are covering proportions of their merchant fees.

How do you work out how much you pay to process card transactions?

This number works out to the percentage surcharge you can put on transactions with that particular card type.

So that’s a different number for Visa, Mastercard® – and the list goes on.

Dynamic surcharging makes the whole process much more simple. Apply instant surcharges to every transaction at the EFTPOS Machine – no manual calculations required.

But what should you charge?

The new RBA surcharging rules require you to set that number at the lowest average cost of acceptance across all schemes.

Compliance is a pain, but fundamental to your business’ continued survival and growth.

Merchants need to be able to demonstrate that their surcharging amount doesn’t exceed their cost of acceptance. Dynamic surcharging does this for you. Learn more.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

You may also like

Australian-based 24/7 support