How can we help?

A single payments partner that delivers reliability, integration and local support for in-person and online transactions, giving enterprise businesses the flexibility, data and control to scale with confidence.

Tyro’s infrastructure powers over a billion transactions annually, trusted by Australia’s most loved brands.

Trusted by over 76,000 Australian businesses who process payments with Tyro every day.

Keeping your terminals and online payments running – even during peak periods.

Tyro eliminates unnecessary middleware so you get faster, more secure transactions.

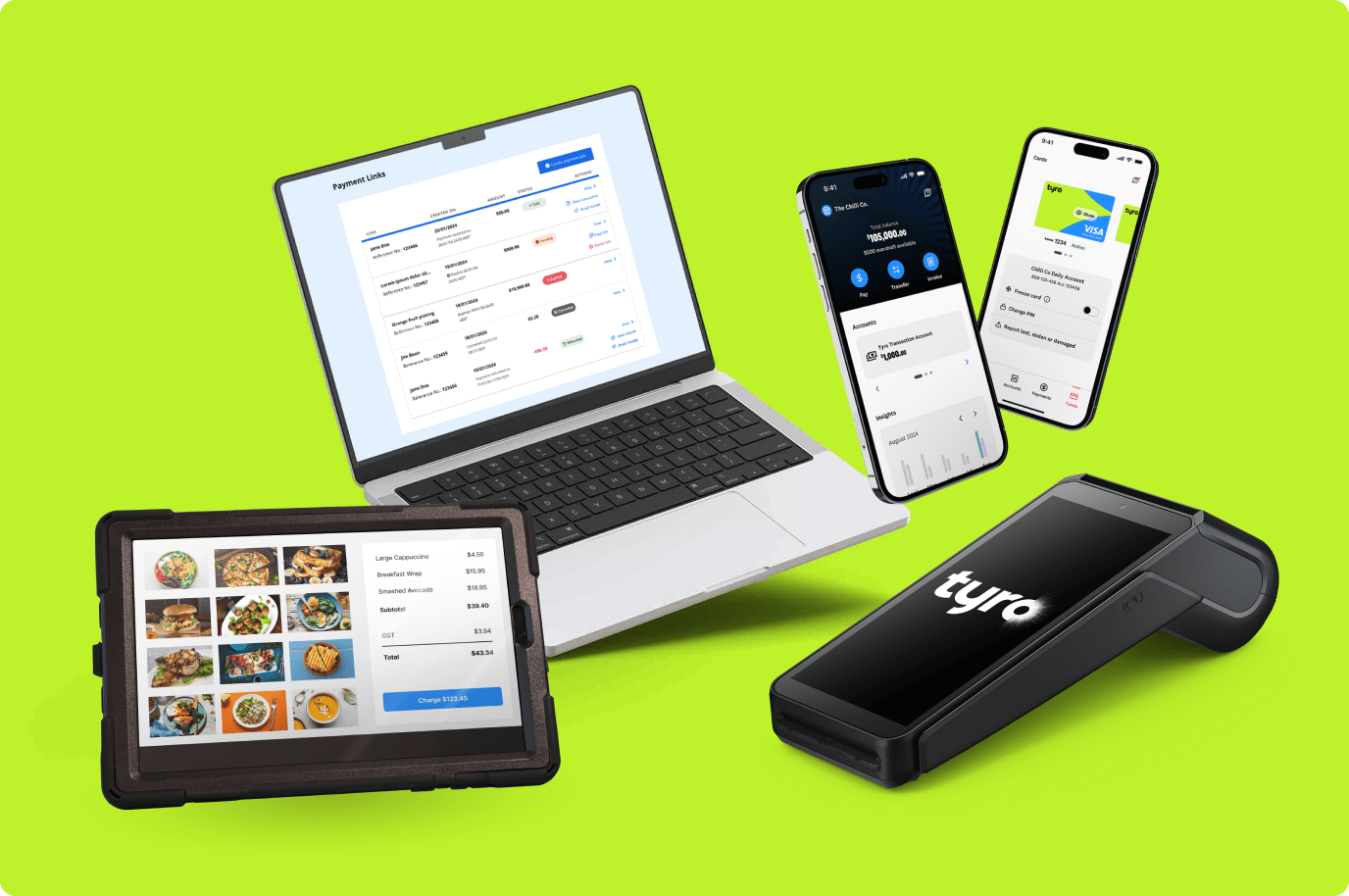

Simplify your operations with one solution for in-person and online. Tyro connects your POS, online payments and reporting into a frictionless payments ecosystem.

Tyro enables you to reach your customers where they are and offer the best customer experience through a single, intelligent payments network.

Your dedicated account manager ensures your business operates seamlessly and scales confidently, from implementation to optimisation.

Tyro supports your migration and accelerates success. You’ll have a dedicated enterprise implementation team ensuring stability, transparency, and performance at every step, from setup to go-live.