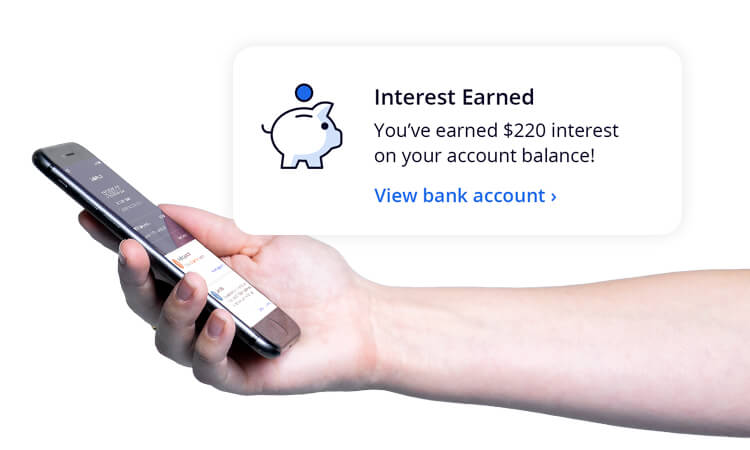

On 07 November 2022 the Base Interest Rate on the Tyro Bank Account changed from 0.10% to 0.50% p.a. The Bonus Interest Rate tiers also changed in line with the table above.

Rates effective 07 November 2022 but subject to change. Interest rates are variable and interest is calculated daily and paid monthly on the third business day. Bonus interest is paid on the portion of the balance that falls within each tier. Tyro EFTPOS and eCommerce Banking customers who do not opt to have funds remain in the Tyro Bank Account and have their daily takings auto-swept to their nominated linked bank account, do not earn any interest.

Get the help you need

Get the help you need