SEE YOUR MONEY SOONER WITH A NO FEE BUSINESS BANK ACCOUNT

With a Tyro Bank Account your daily takings will be in your account the same day *, so you can get paid 7 days a week. Even on weekends and public holidays.

With a Tyro Bank Account your daily takings will be in your account the same day *, so you can get paid 7 days a week. Even on weekends and public holidays.

Receive a rate that grows with your business.

Interest Rates effective as of 07 November 2022

The Tyro Bank Account rewards customers with a higher rate of interest the longer you leave funds in the account. Tyro Bank Account holders will receive bonus interest with rates that increase every 30, 60 and 90 days. There are no minimum deposits needed to earn interest.

Period |

Base Interest Rate |

Bonus Interest Rate |

Total Interest Rate |

|---|---|---|---|

≤30 days |

0.50% p.a. |

n/a |

0.50% p.a. |

>30 but ≤60 days |

0.50% p.a. |

0.65% p.a. |

1.15% p.a. |

>60 but ≤90 days |

0.50% p.a. |

0.80% p.a. |

1.30% p.a. |

>90 days |

0.50% p.a. |

0.95% p.a. |

1.45% p.a. |

On 07 November 2022 the Base Interest Rate on the Tyro Bank Account changed from 0.10% to 0.50% p.a. The Bonus Interest Rate tiers also changed in line with the table above.

Rates effective 07 November 2022 but subject to change. Interest rates are variable and interest is calculated daily and paid monthly on the third business day. Bonus interest is paid on the portion of the balance that falls within each tier. Tyro EFTPOS and eCommerce Banking customers who do not opt to have funds remain in the Tyro Bank Account and have their daily takings auto-swept to their nominated linked bank account, do not earn any interest.

New customers can open a Tyro business bank account when you apply online.

Existing customers can open a Tyro Bank Account in the Tyro Portal.

Same-day settlements into the Tyro Bank Account are paid 7 days a week at a time of your choosing *.

And you can choose to automatically transfer a percentage of your daily takings to your external linked bank account *, leaving the remainder in your Tyro Bank Account to earn interest.

Get seamless reconciliation with integrated bank feeds to Xero and schedule batch payments in Xero – including BPAY and bank transfers, and Xero Payroll.

Your deposits are protected under the Financial Claims Scheme up to $250,000 per account holder, so you’re covered no matter what. ^

For more information visit ASIC’s website

There are no batching fees, no monthly account-keeping fees, no transaction fees, no overdrawn fees or monthly statement fees as part of your Tyro Bank Account.

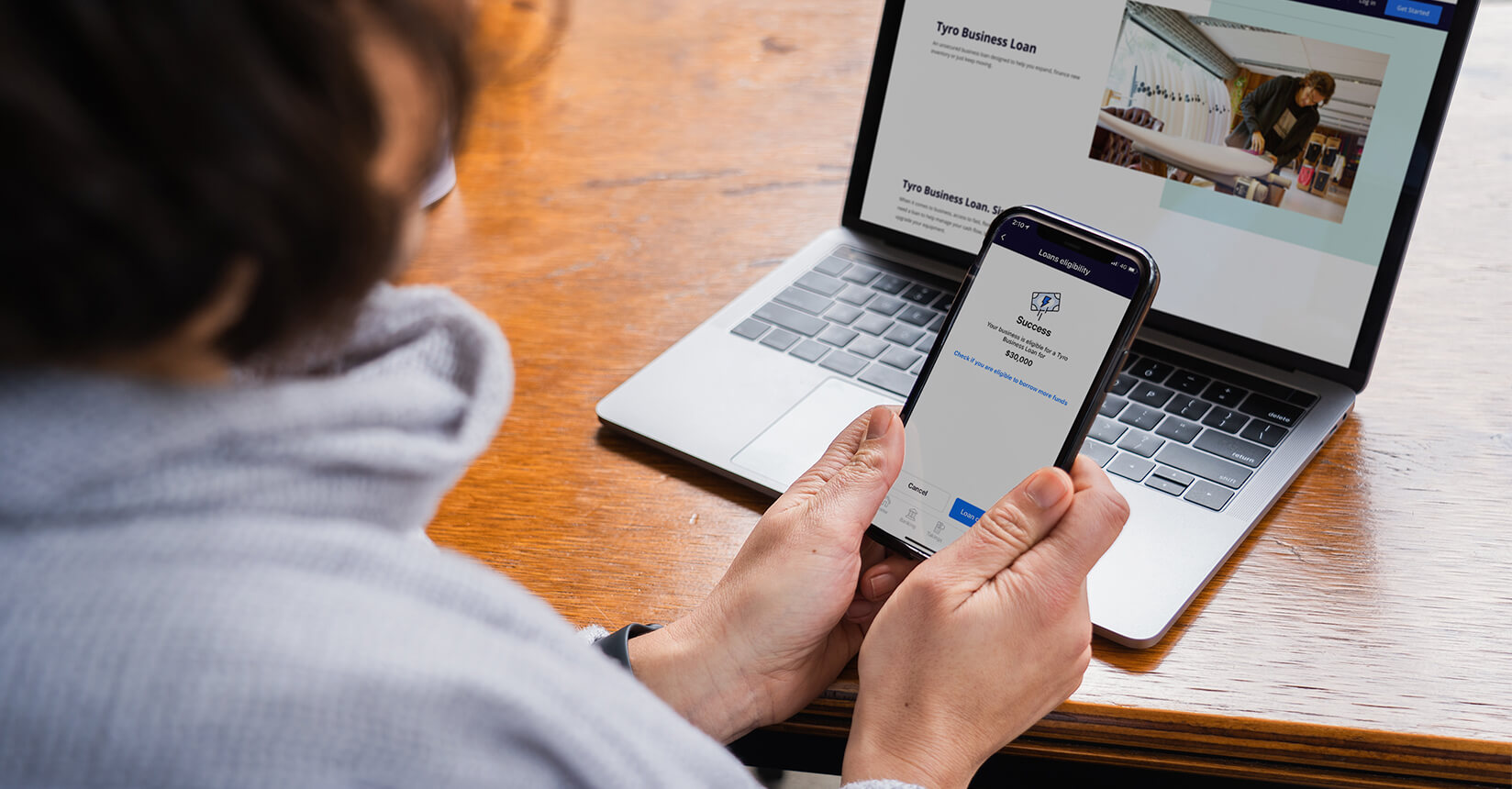

When you have Tyro Bank Account, you can get access to loans up to $350k in 60 seconds, to help you stay on top of cash flow, grow your team, order more stock. § and more.

Set aside funds for future payments by opening one or more term deposits, starting with just as little as $1,000, with exclusive fixed rates, paid at account maturity ¤

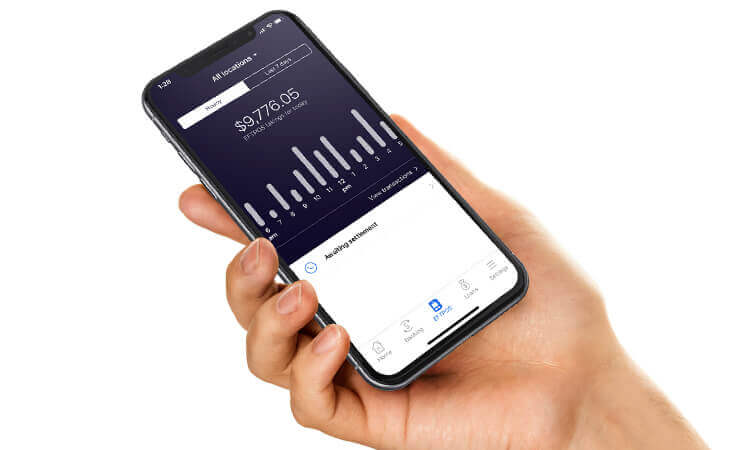

The Tyro App and Tyro Portal lets you access 24/7 mobile banking so you can stay on top of your business from anywhere. Plus, receive notifications, and set up bank transfers, BPAY® and direct debits.

Set and forget your regular payments.

Keep track of monthly interest on your EFTPOS transactions.

Hourly transaction reports to pick up on sales times and trends.

Just-in-time reminders will let you know if funds are low, so you can reschedule bill payments.

Automatically receive a notification if a new payee is included in a batch.

Streamline payments with one single settlement and accept payments fast and securely online and/or in-store.

Keep cash flow moving. Borrow unsecured amounts up to $350,000 δ and make payments that work for your cash flow.

New customers can open a Tyro business bank account when you apply online, and existing customers can open a Tyro business bank account in the Tyro Portal. You can also contact our customer support team for assistance. The process is quick and straightforward and designed to get you started with minimal hassle.

To open an online business bank account with Tyro, you’ll need to provide proof of business registration, identification, and address verification. These documents help us ensure the security and compliance of your account.

You can link your external bank account to your Tyro business account by accessing the online banking portal and following the instructions for account linking. This allows for easy transfers and management of your business bank accounts and funds.

No, you do not need to cancel your existing bank account to use the Tyro Bank Account.

You can transfer settlements and funds in the Tyro Bank Account, out to your externally linked bank account using the Tyro App at any time.

Tyro’s online business banking is highly secure, utilising advanced encryption and security measures to protect your financial data. Our systems are designed to provide a safe and reliable banking experience for your business.

Tyro is an excellent choice for small business banking due to its fee-free business accounts and competitive interest rates that help maximise your savings. Additionally, Tyro offers seamless integration with its EFTPOS and eCommerce solutions, providing a comprehensive banking experience tailored to the needs of small businesses.

With a Tyro business bank account, you can earn interest on your funds based on the amount of time they remain in your account. Interest rates are calculated daily and paid monthly, with higher rates available for longer-term balances *.

Yes. You can authorise another business to direct debit funds from your account by providing them with the BSB and Account number for your Tyro Bank Account. You can also pay bills using BPAY® through the Tyro App. Instructions to do that can be found here: How to add a New BPAY Biller and process a BPAY payment

Learn more. Do more for your business

24/7 mobile banking so you can stay on top of your business from anywhere. Download the app:

The right EFTPOS option can make a real difference to your business.

Tyro Bank Account and Xero working together.